The Bid for Warner Bros. Discovery: What the Smart Money’s Saying About Media, Rates, and 2026

THIS WEEK'S INTAKE 📊 10 episodes across 6 podcasts ⏱️ ~10 hours of market intelligence 🎙️ Featuring: Dan Ivascyn (Pimco), plus experts from Motley Fool, CNBC, Bloomberg, and Focused Compounding 📅 Coverage: December 4th - December 8th, 2025

We listened. Here's what matters.

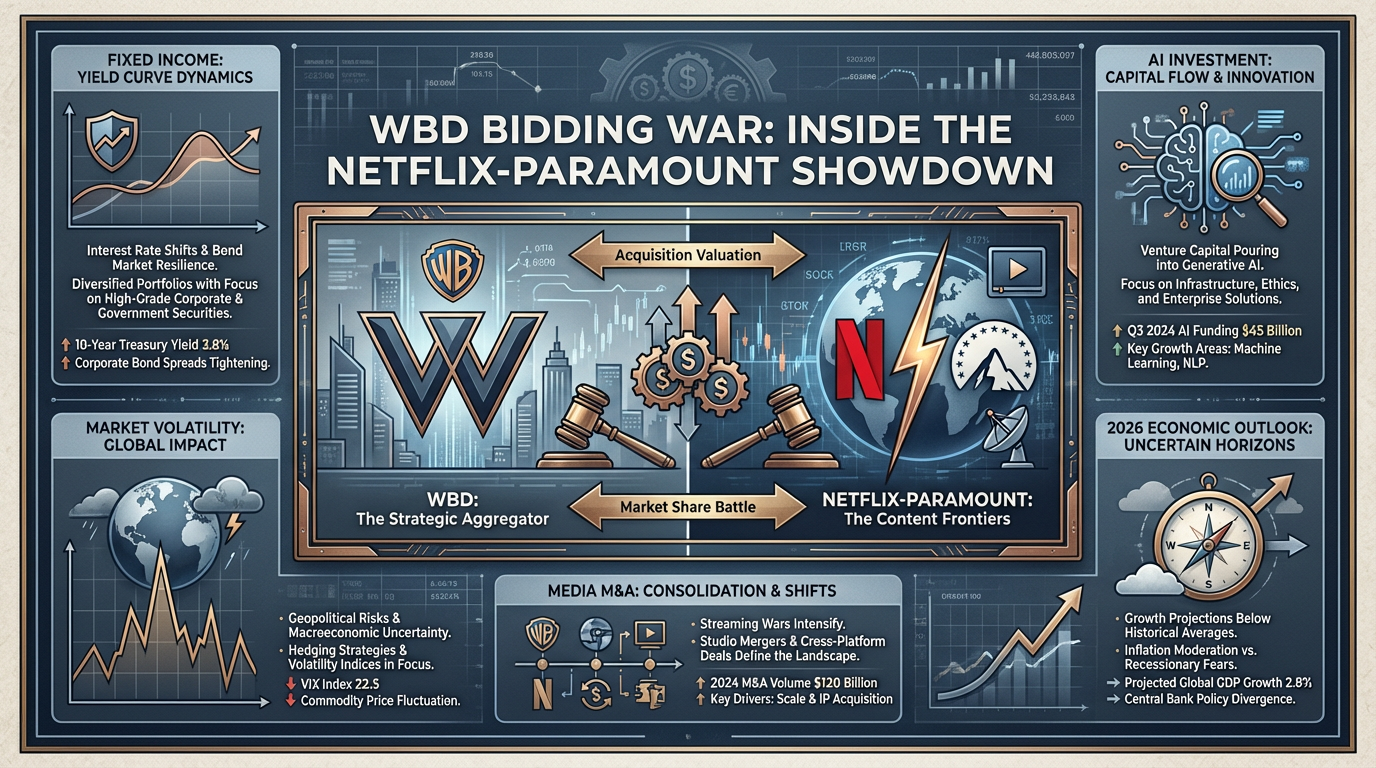

The loudest signal echoing through this week's market commentary isn't about traditional macro data, it's about the very structure of the entertainment industry – specifically, the intense bidding war for Warner Bros. Discovery (WBD). Netflix's rumored $70 billion play, countered by a hostile bid from Paramount, has become a proxy for several deeper market currents: the relentless hunt for growth, the strategic imperative of content ownership, and the question of capital allocation in a high-rate environment.

Beyond the immediate M&A drama, sophisticated investors are grappling with a nuanced 2026 outlook. The fixed income landscape has fundamentally shifted, creating opportunities not seen in years, while the Fed's next move remains a pivotal, albeit uncertain, determinant of market momentum. AI's pervasive influence is clear, yet skepticism mounts around the ROI of massive AI-related capex. This digest cuts through the noise, surfacing the signals that demand attention as 2025 closes and 2026 approaches.

Here's what you need to know:

THE BRIEFING

The Content Wars Escalate: Netflix's Big Bet on WBD

The dominant narrative across multiple podcasts is the heated bidding war for Warner Bros. Discovery. Netflix, reportedly eyeing WBD for upwards of $70 billion, is making a bold play to consolidate its streaming dominance. This move is largely seen as a dual offensive and defensive strategy, designed to fortify its content library against rivals and cement its position in an increasingly competitive landscape. Not to be outdone, Paramount has entered the fray with a hostile, all-cash offer, signaling a desperate fight for survival and scale in the streaming ecosystem. This M&A frenzy underscores the critical importance of a deep and diverse content library for long-term subscriber retention and global reach, pushing valuations in media M&A to staggering levels.

"Netflix is saying, 'We don't need this content library, but we know if we get this content library, we are absolutely crushing the competition.'" — Emily Flippen, Motley Fool Money

The Level: WBD is up 190% over the last six months alone, driven by these acquisition rumors. So What: Expect further consolidation in the streaming space. Companies without proprietary, expansive content libraries will struggle, and the valuations of potential targets will likely remain elevated. Investors should scrutinize balance sheets for capacity to participate or withstand such M&A pressures.

Fixed Income's "New Era": Opportunities Emerge Amidst Fed Uncertainty

Pimco's CIO Dan Ivascyn articulates a significant regime shift in fixed income, moving from an environment of near-zero returns to one offering genuinely attractive opportunities. Higher interest rates have fundamentally re-priced the bond market, making it far more compelling for investors previously forced into riskier assets. This shift is compounded by evolving Federal Reserve policy; while the market anticipates rate cuts, the Fed's independence and its focus on broader economic indicators, rather than just inflation, introduce an element of calculated uncertainty. The discussions highlight the rise of private credit as a viable alternative, now rivaling public markets in size and offering enhanced yields and structural protections in this new paradigm.

"The rate environment could not be more different than when we first started this podcast... the private credit market now basically rivals the public credit market in terms of size." — Dan Ivascyn, Odd Lots

The Level: The 10-year Treasury yield is hovering around 4.5%, a level unseen for much of the last decade. So What: Investors should reassess their fixed income allocations. The "new normal" for rates creates a compelling case for re-engagement with bonds and private credit, offering both income and diversification benefits that were absent for years.

AI Capex vs. ROI: A Growing Disconnect

While the allure of AI continues to drive significant investment, a burgeoning skepticism is emerging around the capital intensiveness of these plays versus their tangible return on investment. Tech giants are pouring billions into AI infrastructure—a circular spend where they're simultaneously building AI models and buying the chips and software to run them. Questions are being raised about the long-term profitability of these ventures. For example, JPMorgan's stock dipped on higher expense forecasts, partly due to AI investments, sparking debate if companies are merely "burning" money without clear returns. The market is increasingly demanding transparency on how these vast AI expenditures translate into bottom-line growth, revenue generation, or genuine productivity gains, rather than just strategic positioning.

"People want to see the banks investing in AI. They don't want to just see the money kind of, you know, be burnt." — CNBC's Fast Money (Guest)

The Level: Google and Meta's combined AI R&D spend expected to exceed $60 billion in 2026. So What: "AI washing" in company narratives will face greater scrutiny. Investors should probe deeper into the specific AI applications, their integration into core business models, and clear metrics for ROI, differentiating between necessary strategic investment and speculative spending.

The 2026 Outlook: Volatility, Uneven Productivity, and Select Opportunities

The consensus for 2026 is a "constructive year, albeit with continuing market volatility." This broad outlook masks critical underlying divergences. Productivity growth, particularly in Europe relative to the U.S., remains a concern, making it harder for some economies to absorb higher rates or generate organic growth. While some individual stocks like Walmart show impressive resilience and valuation, the broader market remains cautious ahead of the upcoming Fed meeting. The environment necessitates a discerning approach, with specific tools like AI-powered trading platforms (e.g., TrendSpider Sidekick) being highlighted for identifying uncorrelated winners and optimizing portfolios to navigate potential S&P 500 inclusion/exclusion shifts.

"We expect 2026 to be another constructive year, albeit with continuing market volatility." — Bloomberg Surveillance (Guest)

The Level: Market volatility (VIX index) is expected to average above 20 in 2026. So What: Active management and sophisticated analytical tools will gain primacy. Passive strategies might face headwinds in a more volatile, uneven market. Identifying sectors and companies with demonstrable productivity gains or strong secular tailwinds will be key to outperformance.

THE HEAT MAP

🔥 Heating Up:

- Media M&A: Bidding war for WBD, intense focus on content libraries (Motley Fool Money)

- Private Credit: Rivalling public markets in size, attractive yields (Odd Lots)

- AI for Stock Picking: Tools like TrendSpider Sidekick identifying S&P 500 candidates (Daily Stock Picks)

- Fixed Income: Return to attractive yield levels after years of dormancy (Odd Lots)

🧊 Cooling Off:

- "Free Money" Era: End of prolonged low-rate environment (Odd Lots)

- Undifferentiated Streaming: Pressure on services without deep content or clear profitability paths (Motley Fool Money)

- Broad AI Enthusiasm: Increasing skepticism on ROI for massive AI capex (Focused Compounding, CNBC Fast Money)

👀 On Watch:

- Fed Rate Cut Timing: Most focused on depth and drivers, not just timing (Bloomberg Surveillance)

- Tech Company GAAP Profitability: Snowflake vs. SentinelOne timelines (Motley Fool Money)

- Productivity Gaps: US vs. Europe, implications for economic growth (Bloomberg Surveillance)

THE CONTRARIAN BET

While many see Netflix's aggressive pursuit of Warner Bros. Discovery as a necessary strategic move, some voices question the wisdom of such a large-scale acquisition, particularly if it involves taking on significant debt. The history of mega-mergers, especially in media, is often fraught with integration challenges and value destruction. A contrarian perspective suggests that rather than engaging in a bidding war, Netflix should focus on organic growth, optimizing its existing content pipeline, and disciplined capital allocation, especially when a strong existing content library is cited as a reason they "don't need" the WBD content. The true value may lie in maximizing an efficient business model rather than chasing scale at any cost.

THE BOTTOM LINE

The market is navigating a complex interplay of strategic M&A, a re-rated fixed income landscape, and a more discerning eye on AI's true impact. The WBD bidding war is a microcosm of the intense competition for scale and content, while the fixed income market offers a compelling, overlooked opportunity. The overarching theme for 2026 is careful navigation: scrutinize capital allocation, be selective in sector exposure, and recognize that the days of indiscriminate growth investing are behind us. The smart money isn't just looking for hot trends; it's looking for value, durability, and a clear path to profitability in a volatile world.

📚 APPENDIX: EPISODE COVERAGE

1. Motley Fool Money: "$70 billion and Chill"

Guests: Chris Hill, Emily Flippen, Jason Hall, Andy Cross

Runtime: 35 mins | Vibe: Enthusiastic takes on high-stakes M&A

Key Signals:

- Netflix's Strategic M&A: Netflix's rumored $70 billion acquisition target of Warner Bros. Discovery is seen as both a defensive and offensive move, aiming to consolidate its position in the streaming wars by gaining access to Warner Bros.' extensive content library, including HBO.

- Content Library Imperative: The deal highlights the critical importance of a deep content library for streaming services, emphasizing Netflix's belief that acquiring WBD's catalog will allow it to "absolutely crush the competition."

- M&A Performance Scrutiny: While large acquisitions often underperform, the hosts express a surprising positive view on this specific deal for Netflix, suggesting unique strategic imperatives might outweigh historical risks.

"Netflix is saying, 'We don't need this content library, but we know if we get this content library, we are absolutely crushing the competition.'"

2. Motley Fool Money: "Profitability Predictions and Paramount Punches Back"

Guests: Chris Hill, Emily Flippen, Jason Hall, Andy Cross

Runtime: 30 mins | Vibe: Sharp analysis of tech earnings and M&A developments

Key Signals:

- Tech Profitability Race: The episode analyzes Q3 2026 earnings for SentinelOne (S) and Snowflake (SNOW), predicting SentinelOne will achieve GAAP profitability faster due to necessary business investment and scaling, while both are expected to get there eventually.

- Paramount's Counter-Bid: Paramount's hostile all-cash offer for Warner Bros. Discovery is discussed as a significant competitive challenge to Netflix's rumored play, intensifying the bidding war and indicating the high strategic value of WBD's assets.

- Earnings Call Disclosures: The discussion highlights the importance of detailed earnings reports in assessing a company's financial health and future prospects, particularly regarding profitability timelines in high-growth tech sectors.

"I can't anticipate Sentinel One generating profits soon because it's just an area where they have to invest in their business and continue to grow, continuing to scale, continue to provide value to th..."

3. Daily Stock Picks: "🚀 Monday Market Gameplan 2026: Beating the S&P, Sidekick Wins & AI-Powered Trades 🤖📈"

Guests: Eric Jackson, Chad Miller

Runtime: 25 mins | Vibe: Actionable insights for active traders using AI

Key Signals:

- AI-Powered Stock Selection: The podcast highlights the use of AI tools like TrendSpider Sidekick for identifying winning stocks and optimizing portfolios, citing its success in predicting Carvana's inclusion in the S&P 500.

- Market-Beating Strategies: Discussion focuses on strategies to outperform the S&P 500, including adopting techniques like the "Turtle Strategy" adapted for modern market conditions.

- Identifying Upcoming Catalysts: Emphasizes the importance of staying ahead of critical market movements and economic news through in-depth research and AI-driven insights to maximize investment returns.

"Sidekick's top three candidates were Carvana, Sofi and Marvel. Those were the top three candidates to get entered into the S&P 500. Well, guess what? It did. Carvana was, was its number one. Its top. ..."

4. CNBC's "Fast Money": "The Global Rate Rise and the Battle for Warner Bros. Discovery. 12/8/25"

Guests: Melissa Lee, Guy Adami, Tim Seymour, Dan Nathan, Karen Finerman

Runtime: 40 mins | Vibe: Rapid-fire opinions on market movers and macro trends

Key Signals:

- WBD Bidding War Dynamics: Discusses Paramount Skydance's hostile bid for Warner Bros. Discovery, framed as "pro consumer, pro creative talent, pro competition" against a potential Netflix merger, emphasizing the competitive nature of the streaming landscape.

- Global Interest Rate Hikes: Touches upon the ongoing impact of global interest rate hikes on various market sectors and company valuations, underscoring the macro backdrop influencing M&A activity.

- Individual Stock Commentary: Provides quick updates and perspectives on specific stocks like Nvidia and Structure Therapeutics, demonstrating how macro trends and M&A news filter down to individual equity performance.

"Our deal is pro consumer. It's pro creative talent. It's, it's, it's pro competition."

5. Bloomberg Surveillance TV: "December 8th, 2025"

Guests: Tom Keene, Lisa Abramowicz, Jonathan Ferro

Runtime: 60 mins | Vibe: Broad macro overview with expert panel discussion

Key Signals:

- 2026 Economic Outlook: Experts anticipate 2026 to be constructive but characterized by continuing market volatility, highlighting the need for vigilance and adaptive investment strategies.

- US-Europe Productivity Gap: Discussion points to a significant productivity difference between the US and Europe, suggesting Europe faces challenges in catching up, even with supportive fiscal policy, impacting global growth narratives.

- Media Merger Challenges: Analysts discuss the complexities and potential outcomes of a Netflix-Warner Bros. Discovery merger, covering fiscal and monetary policy implications for the evolving streaming landscape.

"We expect 2026 to be another constructive year, albeit with continuing market volatility."

6. CNBC's "Fast Money": "JPMorgan Warning Sends Shares Sinking, and a Pairs Trade in the Retail Space 12/8/25"

Guests: Melissa Lee, Guy Adami, Tim Seymour, Dan Nathan, Karen Finerman

Runtime: 35 mins | Vibe: Incisive commentary on specific stock movements and sector trends

Key Signals:

- JPMorgan's Stock Decline: The 5% drop in JPMorgan's stock following higher expense forecasts is viewed as a surprising but potential buying opportunity, indicating market sensitivity to cost management even from top-tier banks.

- AI Investment Scrutiny: Concerns are raised about AI investment spending, with the market demanding clear ROI and rejecting mere "burnt" capital, pushing companies to demonstrate how AI translates to profitability.

- Walmart's Strong Valuation: Walmart's impressive valuation and bullish outlook from technicians are highlighted, positioning it as a resilient player in the retail space amidst broader market uncertainties.

"People want to see the banks investing in AI. They don't want to just see the money kind of, you know, be burnt."

7. Odd Lots: "Dan Ivascyn Is Excited About a New Era in Fixed Income"

Guests: Dan Ivascyn (Pimco CIO), Joe Weisenthal, Tracy Alloway

Runtime: 70 mins | Vibe: Deep dive into the structural shifts in bond markets

Key Signals:

- Fixed Income Regime Change: Dan Ivascyn describes a fundamental shift in fixed income from an era of low returns to a much more attractive environment driven by higher interest rates and evolving market dynamics.

- Rise of Private Credit: The private credit market is highlighted as significantly growing, now rivaling the public credit market in size, offering new avenues for investors seeking yield and diversification.

- Fed Independence and Policy: Discusses the Federal Reserve's potential rate cuts and its independence, emphasizing that the Fed's decisions are driven by broader economic conditions and data, rather than just market expectations.

"The rate environment could not be more different than when we first started this podcast."

8. Focused Compounding: "Ep 475. AI Capex, NFLX/WBD Deal, and the FISV/LRN Meltdown"

Guests: Geoff Gannon, Andrew Kuhn

Runtime: 45 mins | Vibe: Detailed micro-analysis of specific company events and capital allocation

Key Signals:

- AI Capex & Monetization Challenges: The discussion covers the heavy, circular nature of AI-related capital expenditure by tech giants like Google and Meta, questioning the long-term monetization strategies and ROI.

- Meta's Capital Allocation Skill: Mark Zuckerberg is praised as a "great capital allocator" for successful acquisitions like WhatsApp and Instagram, noting his shift from Metaverse spending to focus on more direct AI investments.

- Industry-Specific Valuation: The episode touches on the housing industry and capital cycles, contrasting it with the tech sector, and dissecting the implications of specific company meltdowns like Fiserv and Learnosity.

"Zuckerberg is a great capital allocator. WhatsApp and Instagram have to be one of the greatest acquisitions ever for a company. They've shifted gears from the Metaverse to now spending on all these da..."

9. Unhedged: "Who gets to buy Warner Bros Discovery?"

Guests: Robert Armstrong, Ethan Wu

Runtime: 20 mins | Vibe: Sharp, concise analysis of strategic M&A

Key Signals:

- High-Stakes Bidding War: Highlights the intense competition between Netflix and Paramount for Warner Bros. Discovery, framing it as a "doozy" that will significantly reshape the entertainment industry.

- M&A Impact on Shareholder Value: Discusses the dramatic run-up in WBD's stock (190% in six months) due to acquisition rumors, but also notes its underperformance over a five-year horizon (3%), illustrating the event-driven nature of current valuations.

- Future of Entertainment: Explores the implications of the deal for the broader entertainment landscape, including the importance of content and scale in an increasingly consolidated market.

"So over the last six months, Warner Brothers discovery is up 190%. Would you care to guess what it is? Up over five years? 3%."

10. Bloomberg Surveillance: "Markets Cautious Ahead of Fed Meeting; Netflix-Warner Bros. Deal"

Guests: Tom Keene, Lisa Abramowicz, Jonathan Ferro

Runtime: 55 mins | Vibe: Forward-looking financial market perspectives

Key Signals:

- Fed Meeting Anticipation: The market is cautious ahead of the upcoming Federal Reserve meeting, with experts emphasizing focus on the "depth and drivers" of the rate-cutting cycle rather than just its timing.

- Credit Market Insights: Experts suggest that the peak in credit defaults within the leveraged finance universe is likely past, indicating potential stabilization or improvement in credit quality.

- AI's Impact on Earnings: Discusses the influence of AI on corporate earnings and investment strategies, reinforcing the ongoing scrutiny on how AI investments translate into tangible results.

"What we are most focused on is the depth and the drivers of the Fed rate cutting cycle, not the timing."