THE CARACAS COUP AND THE MARKET'S INDIFFERENCE: NEW RULES FOR GLOBAL RISK

THIS WEEK'S INTAKE

📊 20 episodes across

8 podcasts ⏱️ ~3 hours of market intelligence

🎙️ Featuring: Edward Morse, Reed Hastings, Jay Chaudhry, Julian Emanuel, Brent Johnson

📅 Coverage: January 5-6, 2026

We listened. Here's what matters.

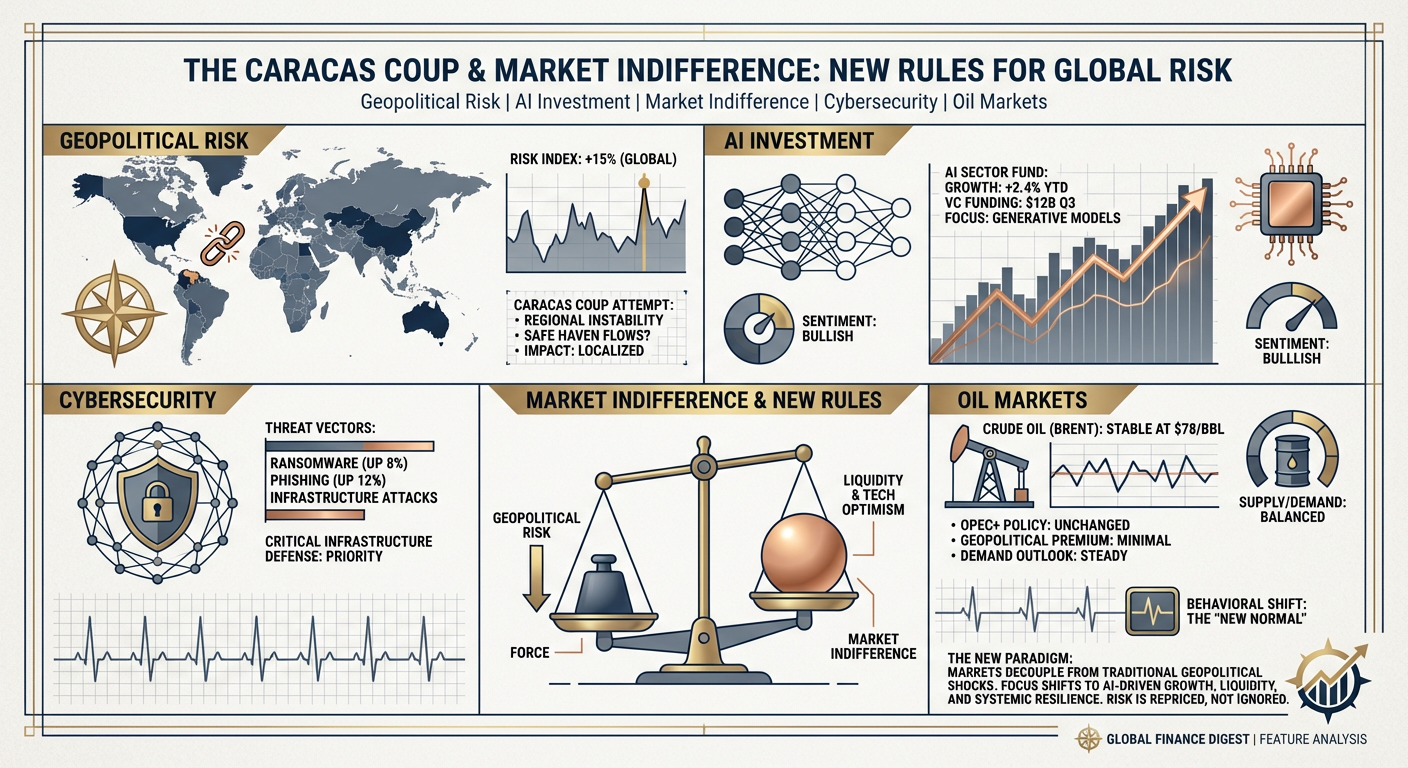

🔥 THE ANCHOR EVENT: VENEZUELA AND THE "NOTHINGBURGER" RESPONSE

The top insight emerging from this week's intake isn't what happened, but what didn't happen. The US orchestrated removal of Venezuelan President Nicolas Maduro – a geopolitical event of significant magnitude involving a major oil producer – was met with a shrug by global markets. Oil prices saw a short-lived bump, defense stocks rallied briefly, and then the conversation quickly moved on to AI and chip exports. This "nothingburger" reaction signals a profound shift in how smart money assesses geopolitical risk in a fragmented, re-dollarizing world. It's not that geopolitics doesn't matter (ask China about its oil supply vulnerability), but the market's assessment of impact is undergoing a major re-calibration.

This market indifference points to two non-obvious conclusions: first, the market correctly priced in the long-term structural impediments to Venezuelan oil production (decayed infrastructure, high extraction costs, political instability), seeing any immediate surge as a fantasy. Second, it suggests a growing understanding that US foreign policy moves, especially when executed decisively and without significant US casualties, may have less systemic market impact than past interventions. The question now becomes: If this kind of event doesn't move the needle, what will? Or perhaps, the market has simply learned to differentiate between headline-grabbing noise and genuine, systemic risk.

"This Venezuelan oil story is pretty much a nothing burger for now for a couple of reasons. We're talking about a very outdated infrastructure. It will take billions after billions in investments to re-activate it." — Real Vision: Macro Mondays

The Level: Venezuela, despite having the largest known oil reserves, produces less than 1% of global supply today. Output costs approach $80/barrel against a $60 global price.

So What: Investors should reassess how swiftly and systemically geopolitical risks are priced in. Short-term noise can obscure the more complex, slower-moving reality of supply and demand, especially when infrastructure is severely degraded. This suggests a higher bar for "shock" events.

📈 AI'S NEXT LEG: PRODUCTIVITY, CONSOLIDATION, AND THE "ALL-IN" BET

While the Venezuela story cooled, the AI narrative continues to heat up, but with a crucial new dimension: a shift from speculative hype to tangible productivity gains and strategic consolidation. The focus is no longer just on NVIDIA's dominance but on the broader ecosystem's maturation. Memory and storage stocks (SanDisk, Western Digital) are surging, driven by AI demand, moving from "boom-and-bust" to "super cycle" narratives. Hyperscalers are increasingly building custom silicon, signaling a next phase of internal optimization and differentiation. This points to a deeper integration of AI, where its impact is seen in operational efficiency and specialized component demand, not just front-page LLMs.

Crucially, investors aren't just holding AI stocks; they're actively planning to add to positions in 2026, indicating a "societal learning curve" where understanding of AI components, like GPUs and LLMs, is now widespread. This is a healthier, more informed landscape, where investors are differentiating between speculation and strategic plays. The "Magnificent Seven" trade might be getting long in the tooth, with smart money looking to the "S&P 493" for AI-driven productivity gains.

"Most people and most investors are much more knowledgeable about the components of AI, machine learning and generative AI versus a few years ago. So we're familiar with terms like GPUs, LLMs, inferencing..." — Motley Fool Money

The Level: S&P 500 could hit 10,000 by decade-end with productivity increasing from 2% to 3% due to AI.

So What: The AI trade is maturing. Look beyond the obvious leaders to the picks and shovels, the custom silicon designers, and the traditional sectors poised for productivity leaps. Concentration risk in mega-cap tech remains, but the underlying cash flows and AI acceleration continue to justify outperformance for those who adapt.

🛡️ CYBERSECURITY SHIFT: ZERO TRUST AND THE END OF THE "CASTLE AND MOAT"

The ongoing digital transformation, accelerated by AI and hybrid work models, is fundamentally reshaping cybersecurity. The era of "castle and moat" defenses (firewalls, VPNs) is over. The new paradigm is "zero trust," a concept gaining significant traction and validating companies like Zscaler. This shift isn't just about better technology; it's about a complete re-architecture of how businesses protect their data and applications. The market is recognizing that traditional security models are inadequate against sophisticated, interconnected threats.

The value proposition of zero trust is that it secures users and applications regardless of location or network, assuming every connection is potentially hostile. This directly impacts operational efficiency and scalability for enterprises. The rapid growth of cloud security firms built on this principle underscores a major, ongoing capital allocation shift in IT budgets.

"The shift from perimeter-based security to zero trust... it's a fundamental architectural change impacting every enterprise." — Motley Fool Money

The Level: Zscaler's market capitalization has grown sevenfold since 2018, riding the zero-trust wave.

So What: Companies enabling the zero-trust model, and those that can effectively implement it, will gain a significant competitive advantage. This is not a niche trend but a foundational change in enterprise IT, representing a durable growth theme for investors.

WHAT'S GETTING ATTENTION

🔥 Heating Up:

- Memory & Storage Stocks: AI demand creating "super cycle" narrative (CNBC Fast Money)

- Zero Trust Cybersecurity: Fundamental shift in enterprise security architecture (Motley Fool Money)

- Dollar Milkshake Theory: Resurfacing as flight to dollar liquidity increases amidst global crises (Bankless)

- Productivity Gains from AI: Moving the S&P 500 towards higher decade-end targets (Bloomberg Surveillance)

🧊 Cooling Off:

- Venezuelan Oil Supply Surge: A short-term "nothingburger" due to infrastructure and cost realities (Real Vision: Macro Mondays)

- Traditional Firewalls/VPNs: Obsolete for modern cloud-native environments (Motley Fool Money)

- S&P 500 Concentration Risk Fear: While acknowledged, cash flows and AI acceleration continue to justify leading stocks (Bloomberg Surveillance)

👀 On Watch:

- Shifting Fed Independence: Potential for increased politicization under certain conditions (Bloomberg Surveillance)

- Fiscal Stimulus from Tax Refunds: Anticipated to impact household liquidity and market behavior (Bloomberg Surveillance)

- US Vulnerability to Global Shocks: New research suggests greater interconnectedness than previously assumed (Odd Lots)

THE CONTRARIAN BET

While the broader market might dismiss the Venezuela situation as quickly as it moved on from last week's non-event, Edward Morse (Hartree Partners) cautions that the government is now in a "crisis of survival" and will have to cooperate with the US. This isn't about oil flowing freely tomorrow, but about US geopolitical leverage changing the long-term game. The contrarian view isn't that Venezuela is an immediate oil boon, but that the US has significantly reshaped the geopolitical calculus in Latin America, an underappreciated strategic shift that will have downstream effects on trade, alliances, and resource access that the market is currently ignoring. The market's nonchalance could be underestimating the long-term, slow-burn impact of US strategic repositioning.

THE BOTTOM LINE

The market is showing a striking new resilience to conventional geopolitical shocks while simultaneously pricing in a nuanced, productivity-driven AI future. The Caracas 'nothingburger' and the confident AI 'all-in' are two sides of the same coin: smart money is increasingly discerning between noise and enduring signal, with structural shifts like zero-trust security and the re-dollarization dynamic shaping capital flows beneath the surface. Don't be fooled by the calm; the tectonic plates are still shifting.

📚 APPENDIX: EPISODE COVERAGE

1. CNBC's "Fast Money": "Fast Money 1/6/26"

Guests: Not specified

Runtime: 45 min | Vibe: AI-driven re-rating of commodity tech

Key Signals:

- Memory Sector Supercycle: Memory and storage stocks like SanDisk, Western Digital, and Seagate are experiencing a significant re-rating, driven by insatiable AI demand, potentially entering a "super cycle" rather than their traditional boom-and-bust pattern.

- NVIDIA's Dominance vs. Broader Rally: While NVIDIA remains strong, there's a growing awareness that its performance might mask a broader semiconductor rally. Discussions suggest increasing competitive threats from hyperscalers developing custom silicon.

- Commodity Price Surge: Copper prices hit record highs above $13,000/ton, attributed to supply chain disruptions and tariffs, signaling broader inflationary pressures in key industrial materials.

"It's what the stock market is saying, it's different this time. I'm not entirely sure that it is."

2. Real Vision: Finance & Investing: "Geopolitical Shock, Asian Equities Rally, and Crypto’s Strong Start: PALvatar Market Recap, January 05 2026"

Guests: Not specified

Runtime: 15 min | Vibe: Market resilience despite geopolitical headlines

Key Signals:

- Market Resilience to Geopolitical Shock: Global markets, particularly Asian equities, showed surprising resilience to US strikes in Venezuela and Maduro's removal, suggesting that this event was either already priced in or not seen as a systemic threat.

- Asian Equity Outperformance: The Nikkei and Kospi surged to record highs, fueled by strong South Korean chip exports and a dovish interpretation of the Bank of Japan's interest rate signals, indicating regional strength detached from Western geopolitical events.

- Bitcoin's Strong Start: Bitcoin remarkably surpassed $90,000, signaling continued institutional adoption and a strong start to 2026 for cryptocurrencies amidst global market stability.

"Asian Pacific markets reached a record high thanks mainly to the Nikkei and the Kospi..."

3. Bloomberg Surveillance: "Trump Reshapes Global Order With Maduro Capture"

Guests: Edward Morse (Senior Advisor and Commodities Strategist, Hartree Partners)

Runtime: 10 min | Vibe: The complex reality of Venezuelan oil

Key Signals:

- Venezuela's Oil Paradox: Edward Morse explains that despite having the largest known oil reserves, Venezuela's heavy, difficult-to-extract oil, combined with severely deteriorated infrastructure, requires enormous capital investment ($100B+) and will take a decade to double production.

- US Leverage and Cooperation: The Venezuelan government's "crisis of survival" necessitates cooperation with the US, which controls exports and maintains a military presence, limiting their options and potentially forcing collaboration, starting with Chevron.

- China's Geopolitical Calculus: China, a major creditor and former political ally, will likely demand repayment, potentially shifting its stance towards the new Venezuelan regime in a complex geopolitical dance.

"Venezuela has the largest known oil reserves in the world. The problem is it's not the kind of oil that the rest of the world needs or wants. And the problem is it's in Venezuela and it's complicated ..."

4. Invest Like the Best with Patrick O'Shaughnessy: "Reed Hastings - Building Netflix - [Invest Like the Best, EP.453]"

Guests: Reed Hastings (Founder, Netflix)

Runtime: 60 min | Vibe: High-performance culture and iterative learning

Key Signals:

- Talent Density as a Core Principle: Netflix's success is attributed to its "talent density" model, characterized by high performance, radical honesty, and the "keeper's test," which prioritizes top talent even amidst high attrition to avoid mediocrity.

- Managing on the Edge of Chaos: Hastings advocates for loose management structures to foster creativity and performance, arguing that over-managing with tight processes and rigid hours filters out high-performing talent.

- Learning from Strategic Mistakes: The Qwikster debacle served as a critical lesson in collective wisdom and not dismissing internal dissent, underscoring the importance of open communication despite a culture of bold bets.

"If you over manage, for example, a tight process or specific hours that you have to be in the office or a wide variety of things, you filter out performance and creativity and the looser that you can ..."

5. Unhedged: "Imperialism and the markets"

Guests: Not specified

Runtime: 12 min | Vibe: Market's geopolitical calculus

Key Signals:

- US Intervention Motivation: The US intervention in Venezuela was not primarily driven by oil, given its unprofitability at current global prices ($80/barrel production cost vs. $60 global price) and the immense investment required for recovery.

- Market Nonchalance: The market's muted reaction to the Venezuelan regime change indicates a sophisticated, non-emotional assessment of actual impact rather than a knee-jerk geopolitical pricing.

- Limited Oil Industry Response: The silence from the oil industry post-Maduro's removal suggests an understanding that Venezuela's oil is a long-term, high-cost proposition, not an immediate game-changer for supply.

"If you're producing at $80, you know you're losing money at the minute. Yeah. I don't know a lot about business, but when you make something for $80 and sell it for 60, my feeling is you're behind the..."

6. Motley Fool Money: "Interview with Zscaler Founder and CEO Jay Chaudhry"

Guests: Jay Chaudhry (Founder and CEO, Zscaler)

Runtime: 20 min | Vibe: Disrupting cybersecurity with zero trust

Key Signals:

- Zero Trust Revolution: Zscaler's success hinges on its "zero trust" cloud security platform, which moves beyond traditional firewalls and VPNs to protect users and applications regardless of location, driving significant market cap growth.

- Accidental Entrepreneur, Intentional Impact: Jay Chaudhry, a serial entrepreneur who sold three prior companies, founded Zscaler with a long-term vision to build a lasting, impactful business based on an architectural shift in security.

- From "Castle and Moat" to "Switchboard": The core innovation is a "switchboard" metaphor for secure access, departing radically from legacy "castle and moat" security and anticipating the shift to cloud-native environments.

"Zscaler, a cloud security company that protects people and applications without using traditional firewalls or VPNs, has a market capitalization of about $39 billion today, which is around seven times..."

7. Bloomberg Surveillance: "Bloomberg Surveillance TV: January 5th, 2026"

Guests: Ed Yardeni (Founder & President, Yardeni Research)

Runtime: 25 min | Vibe: Long-term S&P growth and rebalancing

Key Signals:

- S&P 500 Decade-End Target: Ed Yardeni predicts the S&P 500 could reach 10,000 by the end of the decade, driven by sustained economic growth and an anticipated increase in productivity to 3% due to AI.

- Rebalance from Magnificent Seven: Yardeni suggests shifting allocations away from the "Magnificent Seven" towards the broader S&P 493, financials, industrials, and healthcare, due to AI's broader application in productivity and potential "AI fatigue" in mega-cap tech.

- Politicization of the Fed: Discussions anticipate potential shifts in Federal Reserve independence under a politicized chair, possibly increasing political influence on monetary policy and Treasury yields.

"By the end of the decade we could very well see the market anticipating something like $500 a share for the S&P 500. Put a 20 multiple on it and you get 10,000."

8. Motley Fool Money: "It’s a Small World After All"

Guests: Not specified

Runtime: 10 min | Vibe: Venezuelan oil opportunities for Chevron

Key Signals:

- Venezuela's Production Potential: Despite having vast reserves, Venezuela currently produces less than 1% of the global oil supply. Regime change presents a potential opportunity to significantly increase its output over time.

- Chevron's Unique Position: Chevron, as the only US major currently operating in Venezuela, is uniquely positioned to benefit from renewed investment and infrastructure development, potentially increasing its current 150,000 barrels/day output.

- Long-Term Investment Horizon: Any substantial increase in Venezuelan oil production will be a multi-year effort requiring significant capital, emphasizing a long-term investment horizon for interested parties.

"Venezuela has more proven reserves than Saudi Arabia, yet produces less than 1% of global supply today."

9. Bloomberg Surveillance: "Single Best Idea with Tom Keene: Edward Morse"

Guests: Edward Morse (Senior Advisor and Commodities Strategist, Hartree Partners)

Runtime: 8 min | Vibe: Venezuelan survival crisis and US leverage

Key Signals:

- Survival Crisis for Venezuela: Morse emphasizes that Maduro's removal pushes the Venezuelan government into a "crisis of survival," necessitating cooperation with the US due to limited options.

- US Geopolitical Control: The US maintains significant leverage through its military and naval presence around Venezuela, and its control over Venezuelan exports, making US cooperation essential for the country's economic and political future.

- Long and Difficult Path: The path forward for Venezuela will be long and arduous, with no easy solutions, despite the initial step of removing Maduro.

"Getting Maduro out of that position is a major step and now the government is in a crisis of survival. That survival will require them to cooperate with the US."

10. Bankless: "How the Stablecoin Milkshake will Redollarize the World | Brent Johnson"

Guests: Brent Johnson (Creator, Dollar Milkshake Theory)

Runtime: 35 min | Vibe: Dollar dominance in a debt-fueled world

Key Signals:

- Dollar Milkshake Theory Revisited: Brent Johnson reiterates that while there's a global desire for de-dollarization, the ability to execute it is severely limited, leading to continued dollar strengthening in a crisis due to flight to liquidity.

- Dollar as Store of Value and Medium of Exchange: The dollar's enduring dominance stems from its dual role as both the primary store of value and the most liquid medium of exchange in the global financial system.

- Central Bank's Role: Central banks' primary role is the perpetuation of the state, intervening in debt-based monetary systems to avoid collapse, which can inadvertently delay financial crises but also perpetuate dollar reliance.

"The ability to actually do it [de-dollarize] is dramatically different than the desire to do it."

11. Bloomberg Surveillance: "Venezuela Regroups With New Leader"

Guests: Kevin Gordon (Senior Investment Strategist, Charles Schwab), Liz Ann Sonders (Chief Investment Strategist, Charles Schwab)

Runtime: 15 min | Vibe: Investor education amidst market highs

Key Signals:

- Generational Market Experience Gap: Younger investors (Gen Z, young millennials) have not experienced a true bear market, potentially leading to an equities-only approach driven by fear of missing out rather than diversified strategy.

- Investing vs. Gambling: Sonders differentiates between long-term investing with a plan and short-term gambling, emphasizing the need for education and understanding risk.

- International Diversification Interest: Clients are showing increased interest in international diversification, particularly in Europe and Asia, signaling a potential shift away from pure US equity focus.

"The Gen Z and the young, young millennial cohort of investors for the most part actually has not really experienced what I think of as a real bear market."

12. The Intrinsic Value Podcast - The Investor’s Podcast Network: "TIVP053: Exor NV (EXO): Too Good To Be True? w/ Shawn O’Malley & Daniel Mahncke"

Guests: Shawn O’Malley, Daniel Mahncke

Runtime: 40 min | Vibe: Unlocking value in a family holding company

Key Signals:

- Deep Holding Company Discount: Exor NV (EXO), the Agnelli family's holding company with significant stakes in Ferrari, Stellantis, and CNH Industrial, trades at an unprecedented 60% discount to its Net Asset Value (NAV).

- Ferrari Stake Value Proposition: The market value of Exor's 20% Ferrari stake alone is worth more than 100% of Exor's entire market capitalization, implying investors get the rest of the portfolio for free or at a negative valuation.

- Generational Wealth Management: The conglomerate structure and diversification are rooted in the Agnelli family's multi-generational wealth management strategy, which often leads to market discounting of such vehicles.

"Exor owns 20% of Ferrari's outstanding shares...and yet Exor, as a holding company, trades at a 60% discount to its net asset value. So, you can buy $1 worth of assets for $0.40, with much of those as..."

13. Bloomberg Surveillance: "Single Best Idea with Tom Keene: Ricardo Hausmann & Shannon O'Neil"

Guests: Ricardo Hausmann, Shannon O'Neil

Runtime: 10 min | Vibe: Venezuelan path to fragmentation or new stability

Key Signals:

- Venezuelan Political Legitimacy: Ricardo Hausmann argues against the notion that increased oil production is feasible under Venezuela's current, illegitimate government, highlighting the delusional nature of expecting it.

- Scenarios for Venezuela: Shannon O'Neil outlines two potential futures: either a new figurehead maintains current stability without true regime change, or internal fragmentation occurs due to the inability to control various armed groups.

- No Easy Oil Recovery: Both experts concur that significant oil recovery for Venezuela is a long-term, complex undertaking dependent on profound political and economic reforms, not simply a change in leadership.

"Ricardo Haussmann on a delusional President Trump if he thinks that right now he's going to recover oil production because he's going to tell us major companies to go out and part with billions of dol..."

14. Real Vision: Finance & Investing: "New Year, New Geopolitical Shockwaves | Macro Mondays: January 05, 2026"

Guests: Not specified

Runtime: 20 min | Vibe: Geopolitical "nothingburger" and disinflationary trends

Key Signals:

- Venezuela Oil "Nothingburger": The short-term impact of Venezuelan regime change on global oil supply is deemed minimal due to severely outdated infrastructure requiring billions in long-term investment.

- US Geopolitical Strategy: The US intervention in Venezuela is seen through a broader strategic lens, potentially aimed at denying oil resources to China and gaining control rather than immediate supply increase.

- Disinflation and Fed Cuts: Discussions point to ongoing disinflationary trends in the US and the potential for Fed rate cuts to fuel risk-taking, despite concerns about market complacency.

"This Venezuelan oil story is pretty much a nothing burger for now for a couple of reasons. We're talking about a very outdated infrastructure. It will take billions after billions in investments to re..."

15. The Long View: "Cullen Roche: What Is Your Perfect Portfolio?"

Guests: Cullen Roche (Founder, Orcam Financial Group)

Runtime: 45 min | Vibe: Realistic investment risk and K-shaped economy

Key Signals:

- Tariffs' Limited Impact: Roche argues that extreme tariff predictions did not materialize, and despite media narrative, tariffs have had limited actual impact on the US economy, affecting only a fraction of total trade.

- Exacerbated Inequality by Technology: The K-shaped economy and wealth concentration are long-term trends exacerbated by technology like AI, posing a significant societal problem due to job displacement and wealth accrual to a small segment.

- Defined Duration Investing: Instead of subjective risk profiling, Roche advocates for "defined duration investing," aligning stock allocations to specific future expenditures with different time horizons.

"The vast majority of the tariffs were never enacted and despite the persistent narrative and the media attention it gets, they really have not been that big. We're looking at like 200 billion so far....."

16. Real Vision: Finance & Investing: "US Stocks Near Records, Weak ISM PMI, and Bitcoin ETF Flows Surge: PALvatar Market Recap, January 06 2025"

Guests: Not specified

Runtime: 15 min | Vibe: Divergent market signals

Key Signals:

- US Stocks Near Records, Energy-Driven: The Dow is nearing 50,000, primarily fueled by gains in the energy sector, indicating a sectoral concentration in the broader market rally.

- Weak ISM Manufacturing PMI: US manufacturing PMI contracted for the 10th consecutive month in December (47.9), the lowest in 14 months, impacting the dollar and signaling ongoing industrial weakness.

- Bitcoin ETF Flows Surge: Despite mixed economic signals, Bitcoin ETF flows surged, reinforcing its institutional adoption and showing resilience as an asset class.

"The manufacturing PMI data from ISM disappointed, once again showing contraction for the 10th consecutive month. The reading of 47.9 in December was the lowest in 14 months and below expectations."

17. Motley Fool Money: "AI Investor Outlook for 2026 and Beyond"

Guests: Donato Riccio (Chief Investment Officer, Motley Fool)

Runtime: 20 min | Vibe: Maturing AI investments, understanding over hype

Key Signals:

- Investor Knowledge on AI: Unlike past bubbles, investors are more knowledgeable about AI components (GPUs, LLMs), allowing for better differentiation between investment and speculation.

- Planning to Add AI Positions: A significant number of investors plan to hold or add to AI stock holdings in 2026, indicating confidence beyond "AI bubble" concerns and a deeper understanding of its long-term potential.

- Societal Learning Curve: The market and society are undergoing a rapid learning curve in AI, leading to more aligned expectations with technological realities, particularly in agent technology.

"Most people and most investors are much more knowledgeable about the components of AI, machine learning and generative AI versus a few years ago. So we're familiar with terms like GPUs, LLMs, inferenc..."

18. CNBC's "Fast Money": "Energy Climbs After Maduro Capture, And An Exclusive Interview with Nvidia’s CEO 1/5/25"

Guests: Not specified

Runtime: 45 min | Vibe: Initial market reaction to Maduro, GLP-1 competition

Key Signals:

- Initial Market Reaction to Maduro: The US capture of Nicolas Maduro led to an immediate rally in energy and defense stocks, with Chevron surging, alongside precious metals and Bitcoin, indicating an initial "buy first, ask questions later" response.

- GLP-1 Oral Pill Competition: Novo Nordisk's launch of its GLP-1 oral pill, Wegovy, in the US at a competitive price, intensifies the battle in the obesity drug market, directly challenging Eli Lilly's injectable offerings.

- Long-Term Oil Uncertainty: Despite the initial energy rally, the long-term impact on Venezuelan oil production and global geopolitics remains uncertain, highlighting the complex and drawn-out nature of any recovery.

"Chevron, the only U.S. oil major still in Venezuela surging 5% for its best day since April 9."

19. Bloomberg Surveillance: "Bloomberg Surveillance TV: January 6th, 2026"

Guests: Julian Emanuel (Head of Equities & Derivatives Strategy, Evercore ISI)

Runtime: 25 min | Vibe: Aggressive S&P targets and concentration debate

Key Signals:

- Aggressive S&P 500 Target: Julian Emanuel sets an aggressive year-end S&P 500 target of 7750, driven by the belief that tech mega-cap dominance and AI acceleration will continue due to strong cash flows.

- Concentration Risk Justified: Despite high concentration risk (top 10 stocks now 40% of S&P weight), Emanuel argues the math supports continued outperformance from leading stocks given their strong fundamentals and growth drivers.

- Inflation Data Accuracy Concerns: Discussions highlight concerns about the accuracy of reported inflation and jobs data, suggesting a potential disconnect between public perception and official statistics, impacting the Fed's rate cut decisions.

"The bull market has been led by these names and these themes and we think it just has further to run."

20. Odd Lots: "What Really Happens at a Fed Research Conference"

Guests: Not specified

Runtime: 30 min | Vibe: Fed research, global economic interconnectedness

Key Signals:

- US Vulnerability to Global Shocks: New research presented at the Boston Fed's conference suggests that the U.S. is more vulnerable to global shocks than traditionally assumed, due to deeply interconnected trade, production, and financial networks.

- Tension in Economic Research: The conference highlighted the ongoing tension between academic rigor and policy relevance in economic research, particularly in addressing complex, interdisciplinary global challenges.

- Impact of Tariffs and AI: Discussions covered tariffs, geopolitical tensions, industrial policy, and AI, with a key debate about the US's exposure to global risks in a rapidly changing world.

"The benchmark implication of this view is that U.S. has limited exposure to global risks."