THE AI Hangover & The Search for Signal Beyond Tech

THIS WEEK'S INTAKE

📊 11 episodes across 5 podcasts

⏱️ 6.5 hours of market intelligence

🎙️ Featuring: Jim Cramer, Dan Ives, Neil Dutta, Frances Donald, Michael Collins, and more.

📅 Coverage: December 12th - December 16th, 2025

We listened. Here's what matters.

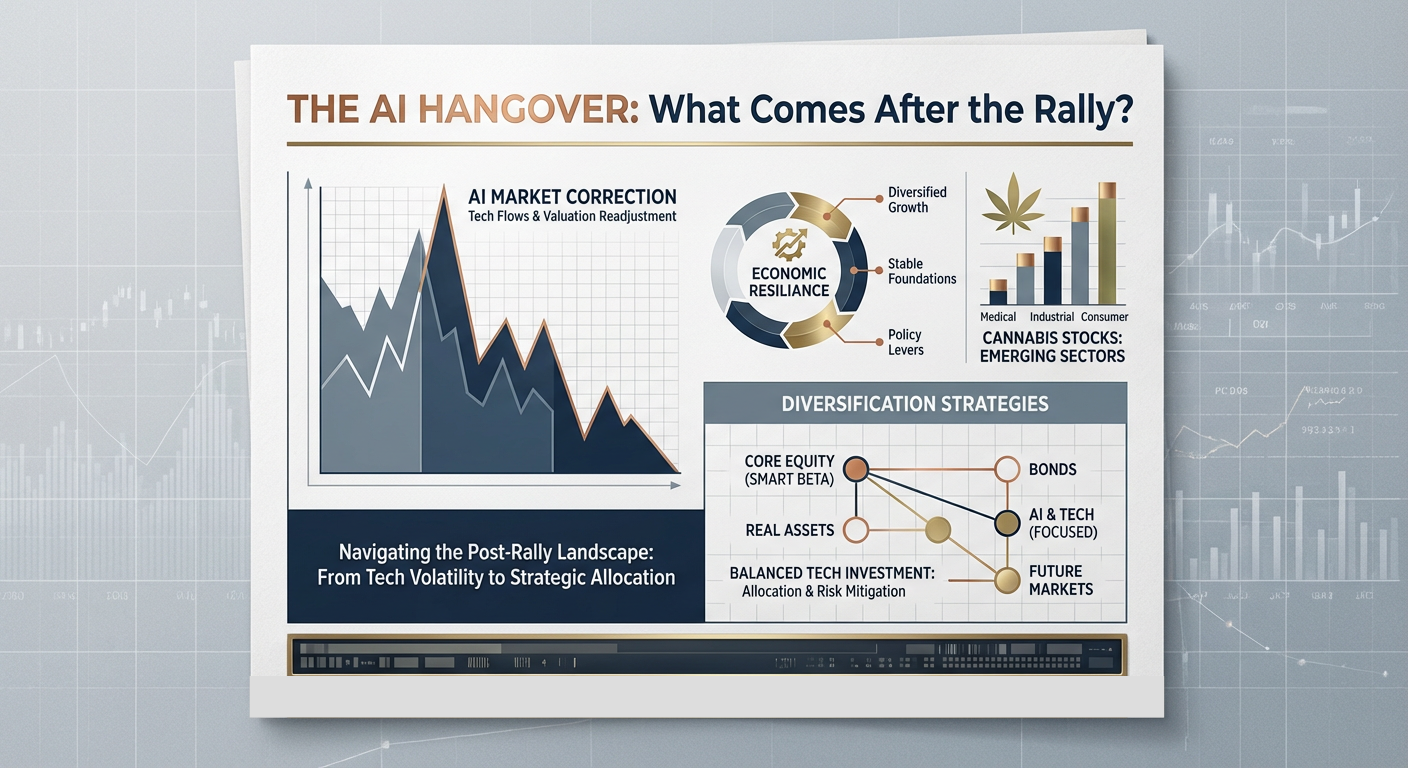

The market is starting to feel the weight of its AI infatuation. After a year dominated by "Magnificent Seven" and AI-fueled rallies, a subtle but significant shift is underway. While the long-term potential of AI remains a consensus, the immediate enthusiasm is giving way to skepticism about valuation, capital expenditure, and the practical implications for corporate earnings. Smart money isn't abandoning AI entirely, but it's clearly asking: What comes next now that everyone's bought into the dream at any price?

The narrative is cracking, revealing a complex landscape where the jobs report's nuances are hyper-analyzed, and an unlikely dark horse—cannabis stocks—are lighting up. This week, we dive into the AI anxiety permeating tech, the surprising resilience of the economy despite softer job data, and where allocators are looking for diversification and alpha as 2026 rapidly approaches.

Here's what you need to know.

TECH'S AI BINGE FACES A REALITY CHECK

The euphoria around artificial intelligence is encountering some friction, specifically around the massive—and increasingly questioned—capital expenditures required to build the necessary infrastructure. While the long-term technological revolution remains undisputed, the market is beginning to scrutinize the cost of that ambition. Oracle and Broadcom's struggles are emblematic of this "AI Angst." After months of relentless inflows, the market is starting to ask about the ROI on data center build-outs.

The setup is a market that has priced in near-perfect execution for AI's rollout. The signal, however, is a growing unease about the immediate financial discipline of tech giants. "People are starting to question where is the money coming from for tech companies?" asked a Bloomberg Surveillance guest on December 15th, highlighting the nascent doubt.

The Level: Oracle's underperformance, despite its AI positioning, suggests investors are no longer blindly buying the narrative.

So what? Investors are shifting from simply buying "AI" to demanding proof of sustainable, profitable AI integration. This means a closer look at balance sheets and discipline from management.

THE SOFT LANDING NARRATIVE GETS A JOB-REPORT BOUNCE

Despite some whispers of economic softness, particularly in the labor market, the prevailing sentiment is that the US economy continues its resilient path. The November jobs report revealed an unemployment rate ticking up to 4.6%, slightly less robust than some expected, but crucially, it wasn't a catastrophic miss. This "not-too-hot, not-too-cold" data keeps the Federal Reserve in a flexible position, fostering the "Goldilocks scenario" that has underpinned risk assets.

The setup is a hypersensitive market looking for any economic crack to justify rate cut narratives. The signal is that even a slightly weaker jobs report isn't derailing the broader bullishness. "This is actually not, not bad. It keeps the Fed in play. And that's the reason why people are bidding up equities and risk assets, even with potentially a worse than expected number," notes Frances Donald (RBC) on Bloomberg Surveillance.

The Level: The 4.6% unemployment rate offers the Fed room, sustaining the equity rally.

So what? Don't bet against the market's current Goldilocks interpretation, but watch youth unemployment (20-24 age group) as a potential early indicator of softening consumer spending.

CANNABIS STOCKS LIGHT UP: UNEXPECTED DIVERSIFICATION FROM TECH

As tech sees some profit-taking and anxiety, an unexpected sector has caught a strong bid: cannabis. News of potential federal reclassification of cannabis from Schedule 1 to Schedule 3 has acted as a powerful catalyst, signaling a significant shift in regulatory tailwinds. This administrative order has massive implications for the industry's operational freedom and access to capital.

The setup is a long-beleaguered industry finally seeing a path to legitimacy and growth. The signal is that regulatory clarity can unlock substantial value overnight. As a "Fast Money" guest put it, "The rescheduling of cannabis from Schedule 1 to 3 would be an administrative order. The implications for this are incredible for the industry."

The Level: The proposed rescheduling to Schedule 3 under federal law.

So what? For investors looking for genuine diversification away from tech, cannabis offers a compelling, policy-driven opportunity that could see sustained momentum.

WHERE TO HUNT FOR ALPHA: B2B Tech & Concentrated Bets

Given the current market dynamics, investors are increasingly looking beyond the headlines for opportunities. Jim Cramer highlighted a strategic pivot: investing in the users of technology rather than just the producers. Companies that integrate AI into their business processes (Business-to-Business tech users) like Procter & Gamble are proving to be more resilient and offer less volatile growth than those burdened by massive AI infrastructure costs. This implies a search for quality and proven business models.

The setup is an uneven tech landscape. The signal is that solid foundational businesses leveraging technology are a safer, more predictable bet. "My favorite tech stocks right right now are the business to business users of technology. You want those who use the technology, not those who make it," stated Jim Cramer on Mad Money.

The Level: Evaluate companies based on their AI adoption rates and cost-efficiency, not just their AI development spending.

So what? Re-evaluate your tech exposure: are you paying for future promises, or investing in current, profitable application? Elsewhere, the Animal Spirits Podcast highlighted Akre Capital Management's "three-legged stool" approach – a concentrated portfolio focused on business quality, management, and reinvestment – as a framework for long-term outperformance, even in challenging markets.

WHAT'S GETTING ATTENTION

🔥 Heating Up:

- Cannabis Stocks — Driven by federal reclassification news (Source: Fast Money)

- B2B Tech Users — Companies leveraging AI without the massive capex burden (Source: Mad Money)

- Goldilocks Narrative — Jobs report keeps Fed in play, supporting risk assets (Source: Bloomberg Surveillance)

- 2026 Bullish Calls — Strategists anticipate another positive year, albeit with challenges beyond tech (Source: Bloomberg Surveillance)

🧊 Cooling Off:

- AI Data Center Spending — Questions about ROI and financial discipline emerging (Source: Bloomberg Surveillance, Mad Money)

- Oracle/Broadcom AI Narrative — Specific tech giants facing "AI Angst" pressure (Source: Fast Money, Mad Money)

- Crude Oil Prices — Significant year-to-date drop, impacting energy sector (Source: Fast Money)

👀 On Watch:

- Youth Unemployment — Potential early indicator of consumer spending weakness (Source: Bloomberg Surveillance)

- Federal Reserve Leadership — Potential changes could influence future policy direction (Source: The Compound and Friends)

- Factor ETFs Performance — Underperformance signals potential regime shift (Source: Bloomberg Surveillance)

THE CONTRARIAN BET

Amidst the widespread AI optimism, a significant undercurrent of skepticism persists, viewing the current AI market as a potential bubble. "I'm hoping for a flush in AI this year," stated a guest on "Fast Money." This view suggests that despite the revolutionary potential, valuations for many AI-centric companies have become detached from reality and are due for a significant correction. The smart money here isn't denying AI's impact but betting that the current pricing is unsustainable, and a deeper pullback will eventually offer more attractive entry points.

THE BOTTOM LINE

The market is showing early signs of an AI hangover, transitioning from blind enthusiasm to a more discerning approach to tech valuations and capital expenditure. While the "Goldilocks" macro picture persists for now, smart investors are seeking diversification in unexpected places like cannabis and focusing on the underlying quality of tech users rather than just producers. The key question for 2026 will be who actually extracts value from AI, and not just who spends the most on it.

📚 APPENDIX: EPISODE COVERAGE

1. Bloomberg Surveillance: "US Payrolls Rise After October Drop"

Guests: Not specified | Runtime: ~28 minutes | Vibe: Data-driven deep dive into labor market signals

Key Signals:

- Labor Market Nuances: While payrolls rose, the unemployment rate ticking up to 4.6% was a point of concern, sparking debate about the underlying strength of the economy. This figure is "going to get attention of investors and policymakers," signaling potential shifts in Fed strategy discussions.

- AI's Limited Employment Impact (So Far): Despite widespread AI narratives, the episode highlighted that "we're really not seeing AI showing up in the labor market overall" in terms of immediate disruption. This suggests that the broader impact of AI on employment will be a longer-term phenomenon, not an immediate destabilizer.

- Shift to Value Stocks: The discussion implicitly pointed to a strategic pivot towards value stocks as inflation moderates and market valuations for growth (particularly tech) become stretched. This reflects a broader rotation away from highly speculative assets towards more fundamentally sound investments.

"The unemployment rate ticking up to 4.6 is going to get attention of investors and policymakers."

2. Bloomberg Surveillance: "Bloomberg Surveillance TV: December 15th, 2025"

Guests: Not specified | Runtime: ~28 minutes | Vibe: Unease growing around tech's AI spend

Key Signals:

- AI CapEx Scrutiny: Investors are increasingly questioning the massive capital expenditures by tech companies in AI. There's a growing sentiment asking, "where is the money coming from for tech companies?" indicating a move towards demanding financial discipline alongside innovation.

- Difficulty in AI Conviction: The process of investing in AI is proving difficult for investors, described as "hard." This suggests that beyond the hype, the tangible returns and clear strategies for AI monetization are still opaque for many, leading to investor hesitation.

- Broader AI Participation Needed: For the economy to truly benefit from AI, there needs to be broader participation beyond a few tech giants. This implies that the benefits need to filter down to a wider array of companies and sectors for sustained economic growth, avoiding a concentrated boom.

"Investors conviction in the process of AI is difficult to have because it's hard."

3. The Compound and Friends: "AI Optimism and Macro Skepticism With Dan Ives & Neil Dutta"

Guests: Dan Ives (Wedbush Securities), Neil Dutta (Renaissance Macro Research) | Runtime: ~30 minutes | Vibe: Contrasting tech's future with macro reality

Key Signals:

- Underestimated AI Adoption: Dan Ives highlighted that only "3% of companies have gone down the AI path in the US today," and even less globally, suggesting a vast untapped market for AI growth. This points to a much longer runway for AI tech adoption than current market sentiment might suggest.

- US Leadership in Tech: The episode emphasized that for the "first time in 30 years the US is ahead of China when it comes to tech," particularly in areas like AI and semiconductors. This frames the US as a dominant force in the coming technological paradigm shift.

- Federal Reserve Leadership Uncertainty: Neil Dutta raised the question of potential changes in Federal Reserve leadership, noting that "Jay Powell remains on an expiring term over the next few months." This introduces a layer of political risk to monetary policy continuity, a crucial factor for market stability.

"It's the first time in 30 years the US is ahead of China when it comes to tech."

4. Bloomberg Surveillance: "Bloomberg Surveillance TV: December 16th, 2025"

Guests: Frances Donald (RBC Capital Markets), Michael Collins (PGIM Fixed Income), Terry Haines (Pangaea Policy), Elyas Galou (BofA Securities), Lucy Baldwin (Citi) | Runtime: ~28 minutes | Vibe: Comprehensive macro review with a positive bias toward 2026

Key Signals:

- Youth Labor Market as Indicator: Frances Donald pointed out that if "the job market is weakening for young folks 20 to 24... if it is less hiring and not so much firing or layoffs," the impact on overall consumer spending might be less severe than feared. This offers a nuanced view on job market health.

- Fed Flexibility Sustains Equities: The less-than-stellar jobs report still "keeps the Fed in play," which is a positive for risk assets. This "not bad" outcome allows the Fed room to maneuver without immediate pressure, fostering a supportive environment for equity performance.

- Bullish 2026 Outlook: Lucy Baldwin shared Citi's "particularly bullish" projections for 2026, driven by continued AI boom momentum and a robust fiscal situation. This suggests that despite near-term volatility, the broader market outlook remains optimistic among major institutions.

"This is actually not, not bad. It keeps the Fed in play. And that's the reason why people are bidding up equities and risk assets, even with potentially a worse than expected number."

5. CNBC's "Fast Money": "Broadcom, Oracle Lead Tech Lower, and Pot Stocks Light Up 12/12/25"

Guests: Not specified | Runtime: ~20 minutes | Vibe: Market shifts driven by AI anxiety and regulatory changes

Key Signals:

- "AI Angst" for Tech Giants: Oracle and Broadcom's underperformance is attributed to "AI Angst," indicating that even large tech players are facing skepticism regarding their AI investments and future profitability. This suggests a more critical eye from investors on AI-driven valuations.

- Anticipated "Flush in AI": One guest expressed hope "for a flush in AI this year," articulating a contrarian sentiment that the AI market is overheated and due for a significant correction. This highlights the growing divide between believers and skeptics in the sector.

- Cannabis Reclassification Impact: The potential rescheduling of cannabis from Schedule 1 to 3 via administrative order is considered to have "incredible" implications for the industry. This regulatory shift is seen as a major catalyst for growth and operational accessibility.

"The rescheduling of cannabis from Schedule 1 to 3 would be an administrative order. The implications for this are incredible for the industry."

6. Mad Money w/ Jim Cramer: "Mad Money w/ Jim Cramer 12/15/25"

Guests: Max Levchin (Affirm CEO) | Runtime: ~20 minutes | Vibe: Strategic shifts away from tech producers to tech consumers

Key Signals:

- Focus on B2B Tech Users: Cramer advocates for investing in "business to business users of technology" like Procter & Gamble, rather than just the producers. This strategy emphasizes companies that leverage technology for efficiency and growth without the direct capital expenditure burden of developing it.

- Common Stocks as Growth Vehicles: The maxim "Never buy a common stock as a bond" stresses that equities should be purchased for their growth potential, with income being a secondary benefit. This reinforces a growth-oriented investment philosophy over yield-seeking in common stocks.

- Consumer Finance Indicators: Affirm CEO Max Levchin's insights on consumer finance and credit card trends offer a pulse on household spending and borrowing behavior. This provides a direct read on a crucial component of the overall economic landscape.

"My favorite tech stocks right now are the business to business users of technology. You want those who use the technology, not those who make it."

7. Mad Money w/ Jim Cramer: "Mad Money w/ Jim Cramer 12/16/25"

Guests: Not specified | Runtime: ~20 minutes | Vibe: Unpacking the AI spending frenzy and market discipline

Key Signals:

- AI Data Center Spending Scrutiny: Wall Street is increasingly concluding that companies involved in AI are overspending on data centers, leading to concerns about profitability and financial discipline. This reflects a shift from awe to analysis regarding AI infrastructure.

- Oracle's Discipline as a Bellwether: If Oracle starts demonstrating discipline in its AI investments, it could signal a broader slowdown in spending across other "hyperscalers." This frames Oracle's approach as a potential trendsetter for the entire tech industry's AI strategy.

- Bond Market's Tech Influence: The episode highlights the bond market's growing influence on tech valuations, particularly for companies like Oracle. This underscores how macro factors like interest rates are increasingly dictating the perceived value of growth stocks.

"Wall Street has concluded that companies involved in artificial intelligence are paying too much money to to build out the data centers."

8. CNBC's "Fast Money": "Crude’s Crumble… And Why A Market Goldilocks Scenario Is Still In Play 12/16/25"

Guests: Tim Seymour, Guy Adami, Karen Finerman, Brian Kelly | Runtime: ~20 minutes | Vibe: Goldilocks persisting despite oil and corporate earnings woes

Key Signals:

- Crude Oil's Significant Drop: Crude oil prices are dramatically down, "more than 20% this year," marking its worst performance since 2018. This steep decline impacts energy sector earnings and offers a tailwind to consumer spending through lower gas prices.

- Accommodative Administration for Energy: Despite the oil price drop, the current administration is seen as "the most accommodative... in history to drilling and EMP companies." This political support could cushion the blow for domestic energy producers and influence future supply.

- Market Goldilocks Scenario Intact: Even with pressures like falling oil prices and mixed corporate earnings, the "Goldilocks" market scenario—where economic growth is moderate and inflation contained—is still considered to be in play. This suggests continued support for risk assets.

"Crude now down more than 20% this year on pace for its worst year since 2018."

9. Mad Money w/ Jim Cramer: "Mad Money w/ Jim Cramer 12/12/25"

Guests: Sharon Price John (Build-A-Bear CEO) | Runtime: ~20 minutes | Vibe: Diversification as a safeguard against AI stock volatility

Key Signals:

- AI Stock Rout: The market experienced a rout in AI and data center stocks, illustrating the volatility inherent in highly concentrated bets. This underscores the risk of "packing all of your money into just a few red hot groups."

- Importance of Diversification: Cramer heavily emphasizes the necessity of diversification to avoid being "blown out of the game" on days of significant sell-offs in specific sectors. This is a foundational principle for managing portfolio risk.

- Future Buy Points for AI: Despite the current downturn, Cramer maintains belief in AI as the "fourth industrial revolution" and suggests that "most of these stocks will be worth buying once their valuations come down." This indicates a patient approach to re-entry.

"If you pack all of your money into just a few red hot groups, you can get blown out of the game on a day like today. Being diversified, knowing what you own the losers without wanting to throw in the ..."

10. Animal Spirits Podcast: "Talk Your Book: The Anti-AI Portfolio"

Guests: John Neff (Akre Capital Management) | Runtime: ~40 minutes | Vibe: Long-term, concentrated value investing vs. market chasing

Key Signals:

- Challenges of Beating the Market: John Neff highlights that "this probably is one of the hardest periods and cycles to actually try to beat the market," given its efficiency and current dynamics. This sets a realistic expectation for active management.

- "Three-Legged Stool" Strategy: Akre Capital Management's investment philosophy focuses on companies with high-quality business models, excellent management teams, and strong reinvestment opportunities. This holistic approach signals a deep dive into fundamentals over short-term trends.

- Long-Term View, No Sell Targets: The strategy includes having "buy targets, we have no sell targets," indicating a highly concentrated, long-term holding period for their investments. This contrasts sharply with short-term trading or chasing momentum.

"I think this probably is one of the hardest periods and cycles to actually try to beat the market."

11. Bloomberg Surveillance: "Bullish Calls for 2026 Emerge"

Guests: David Rubenstein (Carlyle Group Founder), Jeffrey Cleveland (Payden & Rygel), Keith Lerner (Truist Advisory Services) | Runtime: ~28 minutes | Vibe: Optimistic outlook for 2026 with an eye on rotation

Key Signals:

- Universal Bullishness for 2026: There is a consensus among strategists that "not a single strategist on the street that is expecting a down year in 2026." This indicates a strong base-case expectation for positive market returns in the coming year.

- Valuation Not a Timing Tool: Jeffrey Cleveland emphasizes that "valuation is a very poor timing tool" for one-year forward returns, though it gains predictive power over longer horizons. This suggests investors shouldn't base short-term decisions solely on current valuations, even if they appear stretched.

- Investment Rotation Expected: The discussion points to a likely rotation in investment focus, moving beyond the narrow tech leadership seen recently. This implies seeking opportunities in other sectors and perhaps a broader market participation in gains for 2026.

"There's not a single strategist on the street that is expecting a down year in 2026."