MARKET SIGNALS

The Great Liquidity Flood: Is It a Tide Lifting All Boats, or Just Hiding the Rocks?

THIS WEEK'S INTAKE

📊 13 episodes across 8 podcasts

⏱️ ~10 hours of market intelligence

🎙️ Featuring: Michael Burry, David Rosenberg, Jan Hatzius, Vasant Dhar, Ben Lakoff & Arnav Pagidyala.

We listened. Here's what matters.

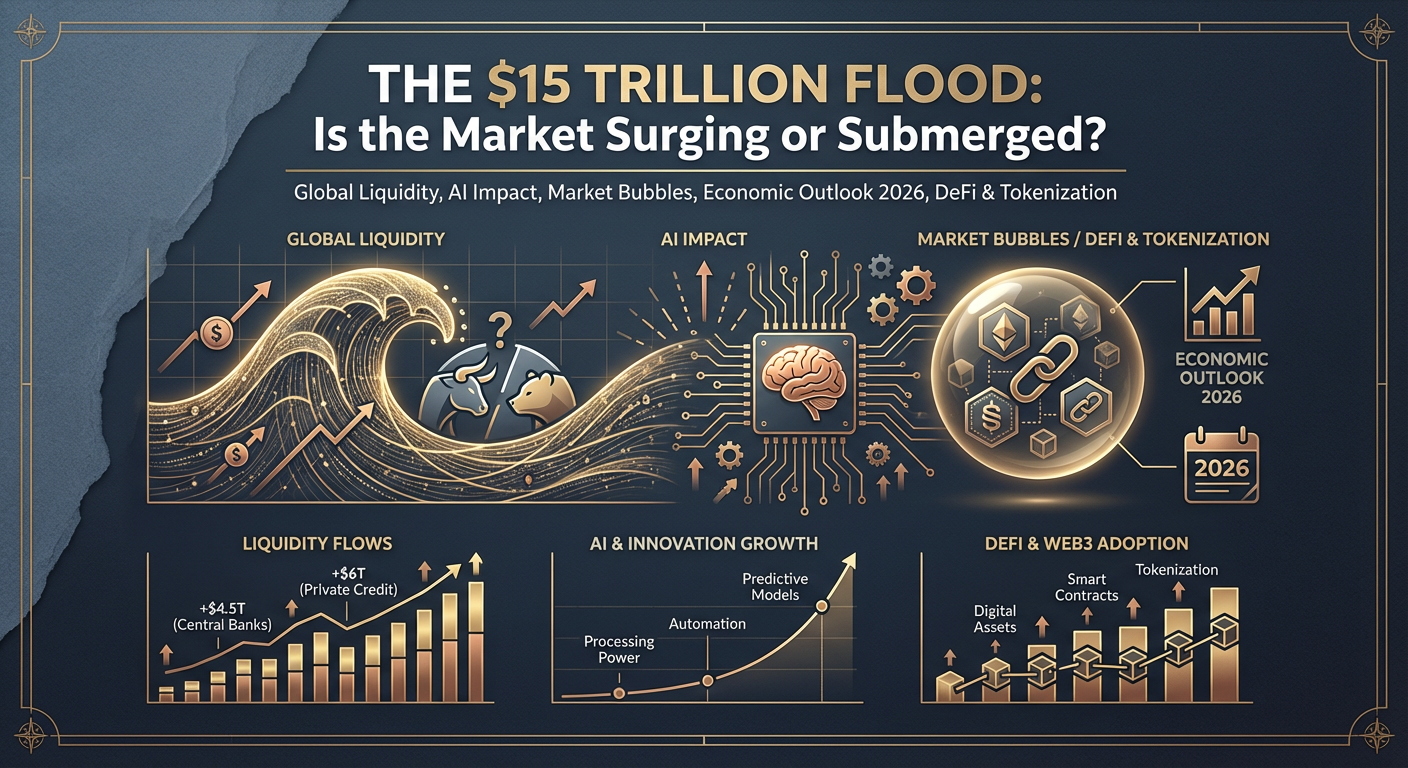

The market chatter this week isn't about if money is flowing, but how much, and what it's covering up. The consensus among the smart money is clear: 2025 saw an unprecedented surge in global liquidity—we're talking a staggering $15 trillion. But while some cheer the "Santa Rally" and record highs, others are scanning the horizon for the dislocations this flood might be obscuring. From sovereign refinancing risks to the sustainability of AI-driven earnings, the underlying tension is whether this liquidity is a benign tailwind or a systemic risk amplifier. The question isn't just what moved markets in 2025, but what the smart money is betting will break—or bend—in 2026.

Here’s what you need to know about the currents shaping the coming year.

THE BRIEFING

The $15 Trillion Liquidity Surge: The Real Engine Behind Record Highs

The Setup: Stock markets finished 2025 on a high, with record valuations and a pervasive sense of optimism. Conventional wisdom often attributes this to strong corporate earnings or a robust economy.

The Signal: The real catalyst, according to several analysts, isn't earnings alone but an unprecedented "flood" of global liquidity. Approximately $15 trillion has entered the global financial system since January 2024, with $13 trillion of that arriving in 2025. This capital infusion has inflated asset prices across the board. The Federal Reserve, under Jerome Powell, is seen as navigating financial conditions, making sure liquidity remains ample enough to avoid crises, a dynamic shaping his legacy more than inflation fighting.

The Voice:

"Global liquidity has expanded by roughly $15 trillion since January 2024. And 13 trillion of that comes this year alone. So this is not a tailwind. It is a flood of capital." — Garrett Baldwin, The Compound and Friends

The Level: $15 trillion in global liquidity expansion since January 2024.

So What: This isn't just about economic growth; it's about financial conditions. Investors need to understand that current valuations may be more a function of this liquidity deluge than fundamental improvements. The question for 2026 becomes: what happens if the tap tightens, or if this liquidity merely masks underlying systemic issues?

AI's Dual Impact: Economic Driver vs. Financial Risk

The Setup: Artificial Intelligence dominated headlines and market performance in 2025, with major tech players like Nvidia seeing meteoric rises. The narrative is that AI is a transformative force.

The Signal: While AI is certainly a powerful theme, its impact on measured GDP growth is still relatively minor, contributing only about 20 basis points over the last few years. The real story is the massive capital expenditure required for AI infrastructure, funneling enormous demand into specific tech sectors. However, this hype also fuels speculative bubbles, drawing parallels to past market exuberance. Michael Burry, of "The Big Short" fame, is notably shorting Nvidia and Palantir, viewing their valuations as unsustainable given the historical patterns of market bubbles. This suggests a growing bifurcation between AI's long-term potential and its short-term, speculative market impact.

The Voice:

"When we look at the impact of AI investment on measured GDP growth, on the numbers that are actually being printed, we're getting only about 20 basis points of contribution over the last three or four..." — Jan Hatzius, Odd Lots

The Level: AI contributes ~20 basis points to GDP growth.

So What: Investors should differentiate between genuine technological adoption and speculative froth. While AI remains a critical long-term trend, the market's current pricing of AI pure-plays might be front-running future earnings well beyond reasonable expectations, indicating significant risk for 2026.

The Cracking "Soft Landing" Narrative and the Looming Credit Crunch

The Setup: The dominant economic narrative entering 2026 suggests a "soft landing" for the US economy—disinflation without a significant recession. GDP figures have been strong.

The Signal: Beneath the surface, there's growing concern that the soft landing narrative is cracking under the weight of conflicting data. While GDP looks robust, the labor market exhibits signs of weakening, with a disconnect emerging between strong top-line economic figures and softening employment trends. Simultaneously, the global financial landscape faces increasing sovereign refinancing risks and leveraged corporate balance sheets. The Treasury market, in particular, is noted as being heavily reliant on hedge funds and foreign buyers, indicating structural fragilities. David Rosenberg forecasts that the Fed will be forced to cut rates more aggressively in 2026, driven by disinflation stemming from declining real wages and consumer spending, rather than the "soft landing" scenario.

The Voice:

"The real challenge for the Fed is that issue between GDP and labor market." — Bloomberg Surveillance

The Level: Continuing jobless claims are ticking higher across several states, signaling a potential shift in labor market health.

So What: The market may be underpricing the probability of a more aggressive Fed easing cycle, as well as the potential for credit market dislocations. Investors should prepare for increased volatility and re-evaluate exposure to highly leveraged sectors or sovereign debt. Gold is being discussed as an essential long-term insurance against an unstable monetary age.

DeFi and Tokenization: A Maturing Frontier Beyond Speculation

The Setup: Crypto has often been associated with speculative cycles and retail-driven hype, making it a fringe asset for institutional allocators.

The Signal: The landscape of crypto investing is fundamentally shifting, moving beyond pure speculation into substantive financial infrastructure. 2026 is poised to see significant developments in DeFi, tokenization, and compliant capital formation. Experts highlight the substantial adoption of Real-World Assets (RWAs) in DeFi, the rise of stablecoin payments, and the emergence of equity perpetuals. Crypto is no longer a contrarian bet but a "consensus insight," demonstrating tangible progress in on-chain lending, verticalized tokenization platforms, and compliant Initial Coin Offerings (ICOs). AI is also beginning to impact crypto-native finance, enhancing efficiency and potentially expanding capabilities.

The Voice:

"This is the first time I would say that crypto is no longer a contrarian thesis. It's no longer a contrarian thing. I would say it's a very consensus insight." — Ben Lakoff, Bankless

The Level: Significant growth in DeFi TVL (Total Value Locked) in RWAs. (Specific numbers not provided, but the sentiment indicates substantial growth).

So What: Allocators should re-evaluate crypto as a maturing asset class with emerging fundamental drivers beyond speculative trading. Opportunities lie in identifying platforms enabling real-world utility and compliant financial innovation, rather than focusing solely on token prices.

THE HEAT MAP

WHAT'S GETTING ATTENTION

🔥 Heating Up:

- Global Liquidity Flood — The overarching driver of asset prices in 2025 and a key concern for 2026 (Source: The Compound and Friends).

- Gold & Silver as Protection — Against increasing sovereign refinancing and monetary instability (Source: The Grant Williams Podcast, CNBC's "Fast Money").

- DeFi Real-World Assets (RWAs) — Maturing crypto infrastructure for tangible value (Source: Bankless).

- Founder-Led Companies — Consistent outperformance due to skin in the game (Source: The Meb Faber Show).

🧊 Cooling Off:

- "Soft Landing" Consensus — Cracks emerging as labor market data conflicts with GDP (Source: Bloomberg Surveillance).

- Nvidia & Palantir Valuations — Under scrutiny as potential bubble assets by contrarian investors (Source: Unhedged).

- China's Economic Impact — Still globally significant, but with growing internal concerns (Source: CNBC's "Fast Money").

👀 On Watch:

- Aggressive Fed Rate Cuts — Expected by some due to disinflationary pressures on consumer spending (Source: MacroVoices).

- Sovereign Refinancing Risks — Global debt loads creating potential credit market dislocations (Source: The Grant Williams Podcast).

- The Labor Market / GDP Disconnect — A key tension point for 2026 economic forecasts (Source: Bloomberg Surveillance).

THE CONTRARIAN BET

While the market cheers record highs and a seemingly resilient economy, Michael Burry remains deeply concerned about the underlying fragility. He highlights the "unique" nature of the 2008 subprime short and, applying similar bubble logic, is betting against high-flying tech giants like Nvidia and Palantir. Burry argues that the current market euphoria, particularly in tech, mirrors past speculative excesses, suggesting that the unprecedented liquidity is creating an illusion of fundamental strength that masks unsustainable valuations. His view is that those celebrating the current rally are missing the structural weak points that could lead to a significant correction, echoing his historical "Big Short" thesis.

THE BOTTOM LINE

The market is awash in liquidity, pushing assets higher and fueling AI hype. But beneath the surface, smart money is scrutinizing the sustainability of this rally, flagging a disconnect between GDP and labor, rising credit risks, and potential bubble valuations in tech. The critical question for 2026 isn't just where growth will come from, but where0 the cracks will appear when the liquidity tide inevitably recedes. Watch for a Fed forced to cut more aggressively and the continued maturation of genuine crypto utility outside of pure speculation.

📚 APPENDIX: EPISODE COVERAGE

1. Motley Fool Money: "Interview with NYU Professor Vasant Dhar: Thinking With Machines"

Guests: Vasant Dhar (NYU Professor)

Runtime: ~27 mins | Vibe: Philosophical, cautionary, data-driven

Key Signals:

- AI's Disempowering Potential: Professor Dhar expresses a concern that AI, while powerful, could lead humanity into a "Huxleyan world" where individuals are gradually disempowered by relying too heavily on machines for decision-making across various life aspects, including investing.

- AI in Long-Term Investing: Despite reservations about AI's societal impact, Dhar acknowledges its practical utility in generating "little edges" in long-term investing through systematic and data-driven applications, emphasizing that continuous, slight advantages compound significantly over time.

- Historical Context of AI: The discussion links current AI advancements to historical developments, emphasizing that systematic algorithmic approaches have been applied in finance for decades, setting the stage for current machine learning capabilities.

"My fear is that we are slipping into a Huxleyan kind of world, perhaps even without our realization, right, that we are gradually disempowering ourselves in many areas of our life."

2. Motley Fool Money: "What Great Investors Do"

Guests: William Green (Author, "Richer, Wiser, Happier")

Runtime: ~30 mins | Vibe: Inspirational, timeless wisdom

Key Signals:

- Timeless Investing Principles: William Green highlights that despite market fluctuations, the core principles of successful investing, much like physics, remain constant. These include long-term patience, deep analytical work, and emotional control, drawing lessons from legendary figures.

- Investor Psychology & Habits: The episode delves into the personality traits and work habits common among top investors like Charlie Munger and Howard Marks, emphasizing critical thinking, mental models, and a commitment to continuous learning as key differentiators.

- Accommodating Reality: A crucial insight shared is the importance of adapting to prevailing market realities rather than attempting to predict the future. Great investors continuously adjust their strategies based on observed conditions, prioritizing flexibility over rigid forecasts.

"You can't predict the future, but what you can do is accommodate yourself to reality as it is."

3. Bankless: "Investing Trends for 2026: DeFi, Tokenization, Capital Formation, Speculation & AI | Ben Lakoff & Arnav from Bankless Ventures"

Guests: Ben Lakoff (Bankless Ventures), Arnav Pagidyala (Bankless Ventures)

Runtime: ~60 mins | Vibe: Forward-looking, crypto-optimistic, strategic

Key Signals:

- Crypto as a Consensus Insight: The guests argue that crypto has evolved beyond a contrarian thesis and is now a mainstream, consensus insight, with substantial adoption and fundamental infrastructure development making it a credible asset class for institutional investors.

- DeFi's Maturing Landscape: Significant strides in Decentralized Finance (DeFi) are highlighted, particularly with the adoption of Real-World Assets (RWAs) and the growth of stablecoin payments, indicating a shift towards practical utility and real-world integration beyond speculative trading.

- Tokenization & Capital Formation: The discussion points to new trends in verticalized tokenization platforms and compliant Initial Coin Offerings (ICOs) as mechanisms to unlock new forms of capital formation, streamlining traditional financial processes onto blockchain rails.

"This is the first time I would say that crypto is no longer a contrarian thesis. It's no longer a contrarian thing. I would say it's a very consensus insight."

4. The Grant Williams Podcast: "Super Terrific Happy Hour Ep. 26: The Downloadable Ringtone"

Guests: Grant Williams (Host), Bill Fleckenstein (Guest)

Runtime: ~55 mins | Vibe: Pessimistic, cautionary, macro-focused

Key Signals:

- Mounting Sovereign Refinancing Risks: The podcast emphasizes the escalating global financial instability due to increasing sovereign debt burdens and the associated refinancing risks. This burden is creating significant stress points in the credit markets.

- Fragile Treasury Market: The US Treasury market is identified as particularly vulnerable, heavily reliant on a few segments like hedge funds and private foreign buyers. This dependency creates a precarious situation, as any shift in these buyers' behavior could trigger widespread dislocations.

- Gold as Essential Insurance: Given the widespread debt, leveraged corporate balance sheets, and capital demands from AI, gold is presented as a crucial long-term insurance asset against monetary instability and potential systemic financial crises.

"How can you have this enormous demand for capital without creating some dislocations in the credit market?"

5. Odd Lots: "Goldman's Hatzius and Snider on the Outlook for 2026"

Guests: Jan Hatzius (Goldman Sachs), Ben Snider (Goldman Sachs)

Runtime: ~45 mins | Vibe: Analytical, institutional, forecast-oriented

Key Signals:

- Strong Corporate Earnings (Beyond Mega Caps): Hatzius and Snider highlight that corporate earnings growth in 2025 was surprisingly robust, even for median S&P 500 companies once mega-cap tech stocks are excluded, suggesting a broader base of economic strength than often perceived.

- AI's Modest GDP Impact: Despite significant market hype and capital expenditure, AI's direct contribution to measured GDP growth has been relatively small so far (around 20 basis points), indicating that its full economic impact is still prospective rather than fully realized.

- 2026 Economic Outlook: The outlook for 2026 points to a continued but perhaps decelerated growth environment, with the market broadening out beyond the dominant tech players that led 2025, suggesting a more balanced spread of investment opportunities.

"What's underappreciated is just how strong corporate earnings growth has been. Even if we strip out the mega caps, the median S and P stock reported earnings growth of about 10%."

6. Bloomberg Surveillance: "Santa Rally Optimism Grows as Stocks Hold Near Record High"

Guests: Tom Keene (Host), Lisa Abramowicz (Host)

Runtime: ~30 mins | Vibe: Upbeat, market-focused, macro-curious

Key Signals:

- Disconnect: Strong GDP vs. Weakening Labor: The hosts discuss a critical tension where robust GDP figures are juxtaposed against emerging signs of weakness in the labor market, posing a challenge for the Federal Reserve's policy decisions and the overall economic outlook.

- Broadening Market Participation: While 2025 was dominated by a few mega-cap tech stocks, the expectation for 2026 is a broadening out of the market rally, with more sectors and companies participating, although overall growth might be less explosive than the preceding year.

- Non-US Equity Opportunities, Precious Metals: Investors are increasingly looking beyond large-cap US equities for opportunities, with precious metals gaining attention as a hedge against market volatility and a means to diversify portfolios given current economic uncertainties.

"The real challenge for the Fed is that issue between GDP and labor market."

7. Bloomberg Surveillance TV: "December 24th, 2025"

Guests: Tom Keene (Host), Lisa Abramowicz (Host)

Runtime: ~25 mins | Vibe: Data-driven, policy-attentive, financial markets focused

Key Signals:

- Labor Market Fragility: Discussions highlight the potential for the unemployment rate to tick notably higher, emphasizing that any significant weakening in the labor market would create a negative backdrop for the economy despite other strong indicators.

- Equities Expensive, But Still Room to Run: While equities are undeniably expensive and show signs of complacency, market positioning is not yet stretched, allowing for the possibility of further new highs as more participants are drawn into the rally.

- Government Shutdowns & Data Anomalies: The episode notes how government shutdowns can distort labor data and general economic readings, making it harder to get a clear picture of underlying economic health and potentially influencing Fed decisions.

"If we’re wrong in the labor market, and we see the unemployment rate notably ticking higher, that would of course be a sort of negative backdrop."

8. The Compound and Friends: "New Year’s Resolutions, the $15 Trillion Liquidity Flood With Garrett Baldwin, Reacting vs Predicting"

Guests: Garrett Baldwin (Guest), Josh Brown (Host), Michael Batnick (Host)

Runtime: ~40 mins | Vibe: Energetic, macro-aware, market-commentary

Key Signals:

- Unprecedented Liquidity Flood: Global liquidity expanded by an astonishing $15 trillion since January 2024, with $13 trillion of that in 2025 alone. This "flood of capital," rather than solely earnings growth, is identified as the primary driver behind record stock market highs.

- Powell's Legacy: Financial Stability: Jerome Powell's tenure as Fed Chair is reframed, suggesting his ultimate legacy will be defined less by inflation control or rate policy, and more by his governance through critical financial stability events, ensuring ample liquidity.

- Risk of Over-Prediction: The hosts warn against over-reliance on precise market predictions, advocating instead for a strategy of reacting to actual market conditions and data, given the complex interplay of global finance and monetary policy.

"Global liquidity has expanded by roughly $15 trillion since January 2024. And 13 trillion of that comes this year alone. So this is not a tailwind. It is a flood of capital."

9. Animal Spirits Podcast: "The Biggest Risk in 2026 (EP. 444)"

Guests: Michael Batnick (Host), Ben Carlson (Host)

Runtime: ~35 mins | Vibe: Conversational, practical, investor psychology

Key Signals:

- Market Resilience Post-Drawdown: The hosts discuss the surprisingly swift recovery of the stock market to new highs, highlighting that even a significant 30% crash from current levels would only reset the market to January 2024 levels, illustrating underlying long-term growth.

- AI and Valuation Hype: The episode touches on the pervasive influence of AI, noting its role in driving market valuations and the potential for a speculative bubble, which raises questions about the fundamental underpinnings of some current prices.

- The "Biggest Risk" Paradox: A key insight is that often, the risks everyone is worried about are the ones least likely to materialize, as market participants have effectively priced them in. The real risks tend to be the unforeseen "unknown unknowns."

"If we had a 30% crash from here for the US stock market, it would bring us back to January 2024."

10. MacroVoices: "MacroVoices #512 David Rosenberg: Will The 2025’s K become 2026’s"

Guests: David Rosenberg (Economist, Strategist)

Runtime: ~50 mins | Vibe: Bearish, contrarian, deeply analytical

Key Signals:

- Aggressive Fed Rate Cuts Expected: David Rosenberg predicts that the Federal Reserve will be compelled to cut interest rates more aggressively than currently priced in by the market. This is due to disinflationary pressures stemming from declining real wages and consumer spending, rather than the "soft landing" consensus.

- Lopsided US Economy: The US economy is characterized as increasingly lopsided, overly reliant on sectors benefiting from AI and vulnerable to a potential faltering of the equity bull market, especially concerning the sustainability of current earnings growth expectations.

- Forecast-Dependent Fed Policy: Rosenberg argues the Fed should be more "forecast-dependent" rather than "data-dependent" because the data they currently rely on is inherently backward-looking and lagged, making it less effective for proactive policy adjustments.

"I'm in the camp that believes that the data will dictate that the Fed probably ends up cutting rates more aggressively than what's priced in right now."

11. The Meb Faber Show - Better Investing: "What the Data Says About Founder-Led Outperformance (w/ Jack Ablin of Cresset Asset Management) | #611"

Guests: Jack Ablin (CIO, Cresset Asset Management)

Runtime: ~40 mins | Vibe: Investment-strategy, academically-informed, asset allocation

Key Signals:

- Founder-Led Outperformance: Public companies still run by their founders demonstrate a statistical edge, outperforming their non-founder-led peers. This is attributed to their long-term vision, risk-taking propensity, and significant equity stakes, aligning their interests with long-term shareholder value.

- Time Horizon-Based Asset Allocation: Cresset's investment strategy prioritizes time horizons over traditional asset classes. This involves aligning investments with the duration of liabilities and goals, which can lead to a more effective asset allocation than conventional methods.

- Opportunities in Private & International Markets: Ablin points to continued opportunities in private markets and international investments as diversification levers and potential sources of alpha, complementing a typically passive approach to public equity markets.

"If any public company that is run by a founder has a slight advantage over their competitors, or at least from a performance point of view."

12. CNBC's "Fast Money": "AI & Metals Fever Breaking?... And Top Tech Picks For The New Year 12/29/25"

Guests: Karen Finerman, Guy Adami, Dan Nathan, Tim Seymour (Hosts)

Runtime: ~20 mins | Vibe: Fast-paced, trading-oriented, current market commentary

Key Signals:

- AI & Metals Pullback as Pause: The recent pullback in AI stocks and precious metals (gold and silver) is generally seen as a temporary pause within a larger upward trend, indicating underlying bullish sentiment for both sectors.

- Complex Moves in Silver and Gold: Concerns are raised about the "complex moves" in silver and gold, particularly when they move in tandem or demonstrate unusual volatility, suggesting potential underlying market uncertainties that traders should monitor closely.

- China's Global Economic Impact: The economic situation in China remains a key topic, with its trajectory directly impacting global markets and commodity demand, influencing investment strategies for both tech and metals.

"This is just a pause to a larger move higher."

13. Unhedged: "From Against the Rules: Michael Burry Speaks"

Guests: Michael Burry (The Big Short Investor), Michael Lewis (Host)

Runtime: ~30 mins | Vibe: Contrarian, skeptical, historical context

Key Signals:

- "Once-in-a-Century" Trade: Michael Burry reflects on the unique nature of his 2008 subprime mortgage short, characterizing it as a true "once in a century" opportunity that stemmed from identifying a massive, overlooked structural vulnerability in the financial system.

- Shorting Modern Tech Giants: Burry reveals his recent short positions against leading tech companies like Nvidia and Palantir, drawing parallels to historical market bubbles and indicating his belief that their current valuations are unsustainable given underlying fundamentals.

- Solitary, Unpopular Convictions: Burry discusses the psychological toll and social friction of holding deeply contrarian views, even when ultimately proven correct, highlighting the difficulty of betting against consensus.

"It was a once in a century type trade. People say once in a century flood, once in a century this. And it's not really true, it happens every 10 years. But this, that opportunity was very unique."