MARKET SIGNALS — DIGEST

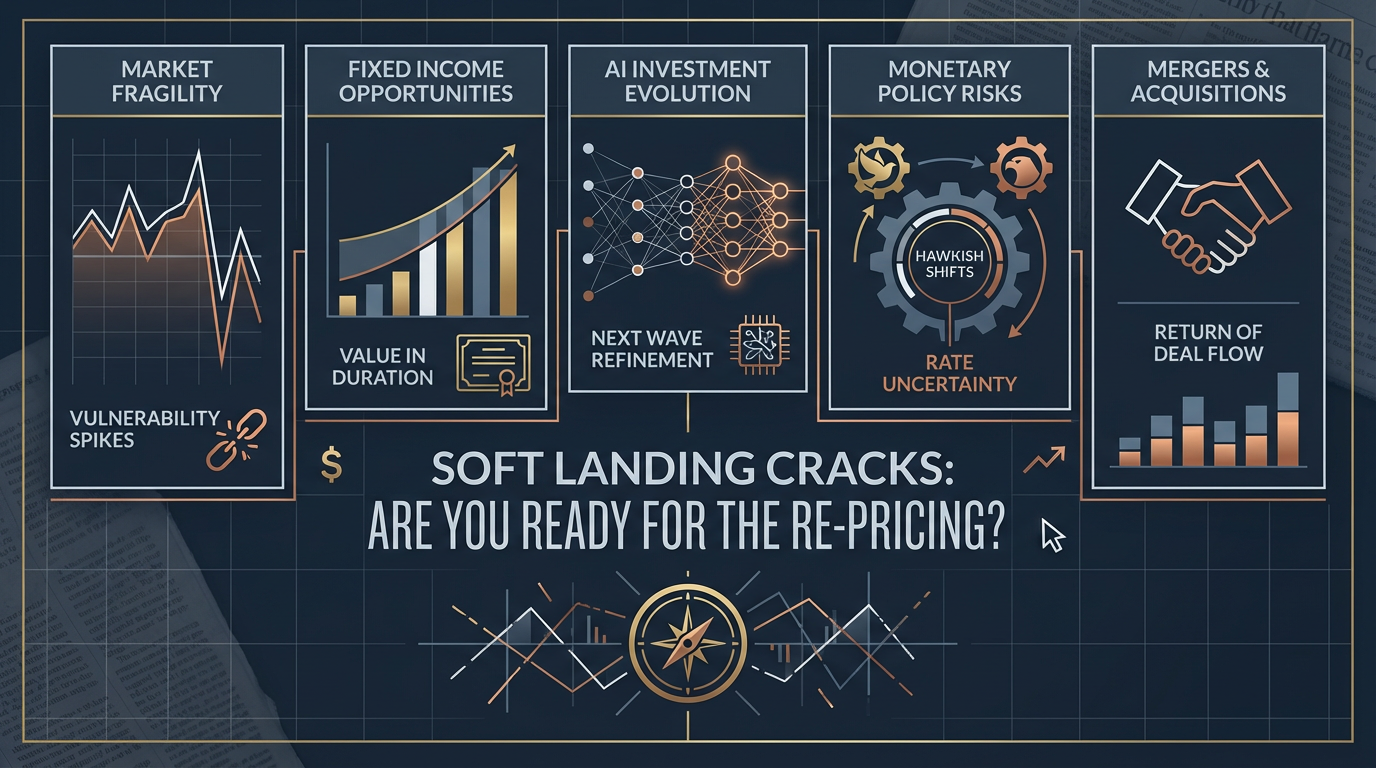

THE SOFT LANDING NARRATIVE IS CRACKING — HERE'S WHAT COMES NEXT

THIS WEEK'S INTAKE

📊 12 episodes across 6 podcasts

⏱️ 6 hours of market intelligence

🎙️ Featuring: Cem Karsan, Jim Cramer, Dan Russo, Stephen Miran, and strategists from JPM, Potomac Funds, and more.

📅 Coverage: December 19th - December 23rd, 2025

We listened. Here's what matters.

The market climate feels schizophrenic. On one hand, persistent bullish sentiment, fueled by tech's dominance and AI euphoria, has driven indices to new highs. On the other, a growing chorus of sophisticated investors is sounding alarms about extreme positioning, the illusion of safety, and the fragility of the "soft landing" narrative. This tension defines the current moment: are we on the cusp of a broad market correction as the underlying economic data shifts, or is this simply a period of healthy rotation beneath the surface? The smart money isn't just asking "what comes next," but "who survives the re-pricing?"

This edition dives into the disconnect between market enthusiasm and growing caution, highlighting where the risks are truly building, what tactical strategies are gaining traction, and the names poised to win (or get wiped out) as the narrative evolves. We'll explore the Fed's delicate dance, the overlooked opportunities in fixed income, and why the "AI battle royale" is more complex than a simple valuation story.

THE BRIEFING

1. The Illusion of Safety: Extreme Positioning and Reflexive Flows

The Setup: Despite whispers of a soft landing, market participants are exhibiting behaviors more typical of late-cycle exuberance. Cash levels are at historic lows, margin debt is at record highs, and market concentration is elevated. This creates an environment where traditional fear gauges may be misleading.

The Signal: Cem Karsan highlights a critical disconnect: the market feels safe because volatility, as measured by the VIX, is low. However, this is largely a function of structural elements and massive passive inflows, rather than genuine balance. The smart money observes a market driven by reflexive flows – buying begetting more buying – rather than fundamental re-evaluation. This positioning creates significant tail risk; if the narrative shifts, the unwind could be violent. Investors are not just fully invested; they are aggressively invested, leaving little dry powder.

The Voice:

"Cash positioning for your average investor is at the lowest ever, below 3%. And margin for investing is also at record highs. So you put those two together and some of this, you know, it's a lot, a lot." — Cem Karsan, Top Traders Unplugged

The Level: Cash positioning for the average investor is "below 3%," a historical low.

So What: This extreme positioning means any adverse shift in economic data or monetary policy could trigger a sharp correction, as there's little capital available to cushion the fall or buy the dip. Risk managers need to prioritize tail protection over incremental alpha.

2. Fixed Income's Quiet Comeback: Yields and Diversification

The Setup: Amidst equity market excitement, fixed income has been largely relegated to the role of dull portfolio ballast. However, a significant opportunity has emerged as yields have reset to attractive levels, offering both income and genuine diversification.

The Signal: Experts are now advocating for a substantial allocation to fixed income, particularly in longer durations, for its ability to generate healthy returns. The "40" in the traditional 60/40 portfolio is no longer just a drag during equity downturns but a robust return driver. The focus is on quality bonds, which provide a defensive hedge against potential equity volatility and offer compelling yields. The U.S. 5- to 30-year bond segment is particularly highlighted.

The Voice:

"The returns on offer from fixed income are really quite healthy." — Bloomberg Surveillance

The Level: The 5- to 30-year bond segment is seen as a sweet spot for duration and yield.

So What: Investors overly concentrated in equities might be missing out on "healthy" and reliable returns from fixed income, which can also act as an unexpected buffer if the equity market narrative breaks. This suggests a re-evaluation of portfolio construction away from just chasing equity beta.

3. The AI Battle Royale: From Broad Enthusiasm to Selective Scrutiny

The Setup: AI has been the undisputed market theme of 2025, driving massive gains in chipmakers, hyperscalers, and large tech. However, the landscape is quickly evolving, moving beyond simple bets on "AI equals growth."

The Signal: The "AI Battle Royale" is heating up, shifting from uniform enthusiasm to a more selective environment. The focus is moving to companies with demonstrable cash flow and actual, rather than projected, profitability from AI initiatives. Concerns are growing about the high valuations of companies like OpenAI, with some questioning the sustainability of its business model without a clear path to profitability. Analysts anticipate a bifurcation in 2026, favoring companies with robust FCF and tangible AI implementation over those simply riding the hype. The competition from more cost-effective models like Google's Gemini Flash 3 is also noted as a threat to incumbents.

The Voice:

"The fluff came out of the market enough so that people can get back to investing. We're going to see a bifurcation happening in 2026 is the companies who have the cash flow to support it and those who..." — CNBC's "Fast Money"

The Level: OpenAI is reportedly seeking another $100 billion in funding, raising questions about its runway to profitability. Gemini Flash 3 offers "a lot more intelligence for less money."

So What: The AI trade is maturing. Blanket exposure to AI-related stocks may no longer be sufficient. Investors must increasingly differentiate between AI enablers, AI beneficiaries with proven cash flows, and AI concept stocks with unsustainable burn rates. Oracle's role as a data center builder, for instance, highlights a more tangible investment in the infrastructure powering AI.

4. Monetary Policy's Narrative Trap and M&A Tailwinds

The Setup: The Federal Reserve's path forward remains a central market determinant. While consensus leans towards cuts, dissenting voices and underlying economic data suggest a more complex picture. Meanwhile, M&A activity is set to become a significant bullish force.

The Signal: Federal Reserve Governor Stephen Miran expresses a dissenting view on immediate rate cuts, arguing that lowering rates now might be premature given persistent inflation risks. He suggests the Fed might be "narrative-dependent" rather than purely "data-dependent," watching market reactions more than just core inflation. This creates a potential for policy missteps or unexpected hawkish pivots. Simultaneously, Jim Cramer identifies takeovers and acquisitions as a powerful, often overlooked, bullish catalyst for 2026. The increasing pace of strategic M&A – from Warner Bros. Discovery deals to private equity take-private moves – can unlock value and drive market performance independently of broader macroeconomic themes.

The Voice:

"I don't see a recession in the near term in part because we are adjusting our policy rate by lowering it, which is appropriate." — Stephen Miran, Bloomberg Surveillance TV (dissenting, implying caution on cuts) "The cheap pillar takeovers and acquisitions, they're going to be an extraordinary force for the Bulls in 2026." — Jim Cramer, Mad Money w/ Jim Cramer

The Level: The Federal Reserve is actively debating the timing and magnitude of rate adjustments, with a key dissenting voice expressed. Noted M&A activities include Warner Bros. Discovery and Janice Henderson.

So What: The market may be too complacent about aggressive rate cuts, introducing risk from a potentially more hawkish Fed. Concurrently, M&A is set to be a significant alpha driver, providing idiosyncratic opportunities even if the broader market struggles. Investors should scrutinize companies ripe for acquisition or benefiting from industry consolidation.

THE HEAT MAP

🔥 Heating Up:

- Tactical Asset Allocation: Quantitative strategies that can go 100% cash and use leverage are gaining traction (Source: Animal Spirits).

- M&A Activity: Acquisitions and take-privates are expected to be a major bullish force in 2026 (Source: Mad Money w/ Jim Cramer).

- Fixed Income (5-30 year): Attractive yields and diversification benefits are making bonds a compelling investment (Source: Bloomberg Surveillance).

- AI Cash Flow Growers: Focus shifting to AI companies with proven profitability and strong cash flow (Source: CNBC's "Fast Money").

🧊 Cooling Off:

- Broad AI Hype Trade: Undifferentiated buying of all AI-related stocks is becoming less effective (Source: CNBC's "Fast Money").

- VIX as a Fear Gauge: Traditional volatility metrics potentially understate market risk due to structural factors (Source: Top Traders Unplugged).

- Pure Index Tracking: Extreme market concentration and divergent themes suggest active management and tactical approaches are more crucial (Source: Top Traders Unplugged, Animal Spirits).

👀 On Watch:

- OpenAI's Valuation/Fundraising: The sustainability of its business model and its impact on broader tech sector sentiment (Source: Motley Fool Money, Daily Stock Picks).

- Fed's "Narrative Dependence": Potential for policy missteps if the Fed prioritizes market signaling over pure data (Source: Bloomberg Surveillance TV).

- US-China Relations: Geopolitical tensions (e.g., Taiwan weapons package) could re-emerge as a market mover (Source: CNBC's "Fast Money").

THE CONTRARIAN BET

While the consensus leans toward a relatively smooth economic glide path with eventual Fed easing, Cem Karsan argues that the market is in an "illusion of safety." He challenges the conventional wisdom that low VIX implies low risk. Instead, he sees current market behavior, characterized by extremely low cash levels and high margin usage, as indicative of a highly fragile, fully-invested system ripe for a violent unwind. His view is that the VIX is a poor fear indicator in this environment, masking significant latent tail risk that traditional portfolio construction models underestimate. This suggests that passive investors are particularly vulnerable to a sudden regime shift.

THE BOTTOM LINE

The market is caught between a receding soft landing narrative and the structural fragilities of extreme positioning. Focus isn't just about identifying growth, but on safeguarding capital through tactical strategies and quality fixed income, while selectively targeting AI winners with proven cash flows and M&A-driven alpha. The biggest risk is complacency, as the illusion of safety masks underlying vulnerabilities that could trigger a swift re-pricing.

📚 APPENDIX: EPISODE COVERAGE

1. Top Traders Unplugged: "SI379: The Illusion of Safety in a Fully Invested Market ft. Cem Karsan"

Guests: Niels Kaastrup-Larsen (Host), Cem Karsan (Karsan Value Partners) Runtime: 1 hour 15 minutes | Vibe: Deep dive into market mechanics and hidden risks

Key Signals:

- Extreme Positioning & Low Cash: The average investor's cash positioning is at its lowest ever (below 3%), while margin for investing is at record highs. This indicates a fully invested market with little dry powder, increasing fragility.

- VIX as a Misleading Indicator: Cem argues the VIX is a poor fear indicator in the current environment, as structural factors like passive flows and fixed income duration provide a false sense of security. Volume, rather than implied volatility, might be a better barometer of true market stress.

- Portfolio Construction & Tail Risk: Traditional 60/40 portfolios are vulnerable, and the focus should be on building portfolios for various risk regimes, including extreme tail events. True risk lies in the distribution of outcomes, not just central tendencies.

"Cash positioning for your average investor is at the lowest ever, below 3%. And margin for investing is also at record highs. So you put those two together and some of this, you know, it's a lot, a lot."

2. Bloomberg Surveillance: "Markets Eye Tech Turnaround"

Guests: David Kelly (JPMorgan Asset Management), Jonathan Ferro (Host), Lisa Abramowicz (Host), Tom Keene (Host) Runtime: 45 minutes | Vibe: Optimistic but cautious outlook on US economy and market segments

Key Signals:

- Economic Resilience & Market Strength: The market's strength is attributed to institutional factors like stock buybacks and embedded capital gains momentum, implying the economy's performance isn't the sole driver. Corporate earnings have been robust in 2025.

- Weakness in Wages Amid Strong Earnings: While earnings are strong, a "fair amount of weakness in wages" is observed, suggesting a potential disconnect between corporate performance and household income, which could impact future consumption.

- Stable Rate Picture: The expectation is for a relatively stable interest rate environment, which should provide support for the market, particularly for equities. This stability aids in planning and reduces interest rate volatility risk.

"Why is the market so strong when the economy is there? And I think part of the reason is because there are institutional things within our market. Things like stock buybacks, embedded capital gains mo..."

3. Motley Fool Money: "OpenAI Wants Another $100 Billion"

Guests: Chris Hill (Host), Deidre Woollard, Jason Moser, Mary Long Runtime: 30 minutes | Vibe: Skeptical but curious, diving into AI valuations and market dynamics

Key Signals:

- OpenAI's Valuation and Profitability Concerns: OpenAI's pursuit of a further $100 billion in funding raises questions about the sustainability of its business model. The lack of clear profitability at such valuations is a key point of contention.

- Competition from Cost-Effective AI Models: Google's Gemini Flash 3 is gaining traction due to its cost and compute efficiency, offering more intelligence for less money. This poses a significant challenge to larger, more expensive AI models.

- AI's Trajectory & Valuation: The overall AI market is attracting massive investment, but the need for profitability and efficient models is intensifying. High expectations can be a "real killer" for tech stocks, particularly in AI.

"The question is how long can they keep raising money without having a profitable business model?"

4. Animal Spirits Podcast: "Talk Your Book: A Tactical Strategy That Actually Works"

Guests: Michael Batnick (Host), Ben Carlson (Host), Dan Russo (Potomac Fund Management) Runtime: 55 minutes | Vibe: Enthusiastic and detailed, exploring a unique investment approach

Key Signals:

- Tactical Asset Allocation Outperformance: Potomac Funds utilizes a quantitative strategy that can move up to 100% to cash and deploy leveraged exposure, allowing them to consistently outperform the S&P 500 while reducing drawdown.

- Addressing Drawdown Risks: The strategy aims to protect capital during market downturns, solving a common problem for tactical funds that often fail to generate sufficient upside during bull markets. Their focus is on navigating different market environments.

- Quantitative, Rules-Based Approach: The firm's composite model (the "Four Hour Algorithm") is entirely quantitative, removing emotional biases and enabling disciplined decisions regardless of market conditions.

"At Potomac, we can will and do move our portfolios 100% to cash. If our composite model tells us that that's the right move, and we'll obviously get into that a little further."

5. Bloomberg Surveillance: "Markets React to Last Major US Eco Data of 2025"

Guests: Jonathan Ferro (Host), Lisa Abramowicz (Host), Tom Keene (Host), Steven Major (HSBC) Runtime: 40 minutes | Vibe: Forward-looking, focused on economic forecasts and fixed income

Key Signals:

- Healthy Returns in Fixed Income: The current market offers "healthy returns" from fixed income, making it a compelling component of a diversified portfolio not just for stability but for generating income.

- Focus on 5 to 30-Year Bonds: The sweet spot for fixed income allocation is specifically identified as the 5- to 30-year segment of the curve, suggesting particular opportunities in longer duration.

- U-Shaped Economic Recovery Potential: While not the primary forecast, the possibility of a U-shaped recovery (a longer, drawn-out rebound) is considered, highlighting the need for vigilance and adaptable investment strategies.

"If you want one number on the curve, it's probably 5 to 30 year."

6. Mad Money w/ Jim Cramer: "Mad Money w/ Jim Cramer 12/22/25"

Guests: Jim Cramer (Host) Runtime: 45 minutes | Vibe: High energy, stock-specific, and bullish on M&A

Key Signals:

- M&A as a Major Bullish Force in 2026: Cramer predicts that takeovers and acquisitions, driven by cheap capital, will be an "extraordinary force for the Bulls" in the upcoming year, highlighting value-unlocking deals across sectors.

- Value Beyond "Expensive" Headlines: He challenges the perception of all stocks being overpriced, pointing to instances like Warner Bros. Discovery at $7, arguing that underlying value can be overlooked by broad market assessments.

- Sector-Specific Opportunities: Cramer offers insights across various sectors, including retail (Home Depot, Costco) and technology (Rubrik Inc.), emphasizing differentiated performance and company-specific catalysts.

"The cheap pillar takeovers and acquisitions, they're going to be an extraordinary force for the Bulls in 2026."

7. CNBC's "Fast Money": "AI Battle Royale… And The State Of U.S.-China Relations 12/19/25"

Guests: Melissa Lee (Host), Karen Finerman, Dan Nathan, Guy Adami, Brian Kelly Runtime: 35 minutes | Vibe: Pragmatic, shifting focus to fundamental strength in tech

Key Signals:

- Bifurcation in AI Trade for 2026: The market is expected to shift from a monolithic, broad-based AI trade to a more selective environment, favoring companies with robust cash flow generation. "Fluff" is coming out of the market.

- AI Hardware vs. Hyperscalers: The "AI Battle Royale" refers to the intensifying competition and performance discrepancies between chipmakers (e.g., Micron, Nvidia) and cloud providers (e.g., Oracle).

- US-China Relations as a Market Factor: The $11 billion weapons package to Taiwan signals continuing geopolitical tensions that could impact global markets and supply chains, particularly for tech and manufacturing.

"The fluff came out of the market enough so that people can get back to investing. We're going to see a bifurcation happening in 2026 is the companies who have the cash flow to support it and those who..."

8. The Long View: "Best of The Long View 2025: Investing"

Guests: Christine Benz (Host), Jeff Ptak (Host) Runtime: 40 minutes | Vibe: Reflective and educational, consolidating key investment lessons

Key Signals:

- Importance of International Diversification: While the US market has performed strongly, experts warn against being entirely US-centric. International and emerging markets offer diversification and potential for future outperformance.

- US Market Multiple Expansion: A significant portion (85%) of the US market's recent gains has come from multiple expansion rather than earnings growth, suggesting valuations may be stretched and a potential for mean reversion.

- Risks of Illiquid Private Assets: Over-allocation to private equity and other illiquid assets poses risks, particularly given their lack of transparency and potential for underperformance in certain market regimes.

"The most expensive bet in life is to be short of America. But it doesn't mean your entire portfolio should be in the US."

9. Daily Stock Picks: "Quad Witching Chaos, Crypto ‘House of Cards’ & 2026 AI Winners: JPM’s Top Stocks, Big Dividends & OpenAI Risk ⚠️📈🧠"

Guests: David Kelly (JPMorgan Asset Management), Other hosts Runtime: 25 minutes | Vibe: Opportunistic, highlighting specific investment strategies

Key Signals:

- Quadruple Witching Day Volatility: This event can create market choppiness and opportunities for informed investors, emphasizing active strategies during periods of high options expiry.

- OpenAI Valuation Risk: The episode reiterates concerns about OpenAI's valuation and its potential to create volatility in related tech stocks if expectations aren't met, echoing sentiments about high expectations.

- Defensive Strategies for 2026: The focus shifts to defensive plays, big dividends, and JPM's top stock picks as strategies for navigating anticipated market changes and volatility in the coming year.

"If OpenAI doesn't get the valuation, realize that could create the volatility that some like Tom Lee talked about."

10. Bloomberg Surveillance TV: "December 22nd, 2025"

Guests: Stephen Miran (Federal Reserve Governor), Jonathan Ferro (Host), Lisa Abramowicz (Host) Runtime: 60 minutes | Vibe: Scrutinizing monetary policy and economic forecasts

Key Signals:

- Dissenting View on Rate Cuts: Federal Reserve Governor Miran expresses a dissenting opinion on the current expectation for rate cuts, suggesting that lowering rates might be premature and could re-ignite inflation.

- Fed's "Narrative Dependence": Miran implies the Fed might be overly influenced by market narratives rather than purely "data-dependent," watching market reactions and sentiment closely. This suggests a potential for policy missteps.

- Importance of Avoiding Groupthink: The discussion emphasizes the critical need for independent thought within monetary policy-making to prevent errors and ensure robust decision-making.

"I think it's really, really important to avoid groupthink. I think if you, if you fall into groupthink, you stop questioning where you could be wrong and then it just becomes much easier to be a compl..."

11. Bloomberg Surveillance TV: "December 23rd, 2025"

Guests: David Kelly (JPMorgan Asset Management), Other hosts Runtime: 60 minutes | Vibe: Optimistic on equities, with a critical eye on specific economic factors

Key Signals:

- Bullish Prospects for Equities: Despite some underlying concerns, there's general optimism for the equity market, with participants believing it's "priced for an economy that's performing well."

- Tariffs Passed Through to Consumers: The discussion highlights that tariffs "ultimately pass through to consumer prices," implying that trade policy can contribute to inflationary pressures.

- M&A in Media: Potential significant M&A activity is discussed, specifically the rumored acquisition of Warner Bros. Discovery by Paramount Skydance, signaling consolidation trends in specific industries.

"Markets aren't really pricing in a lot of worries. We're priced for an economy that's performing well."

12. Mad Money w/ Jim Cramer: "Mad Money w/ Jim Cramer 12/19/25"

Guests: Jim Cramer (Host), John Gibson (Paychex CEO) Runtime: 45 minutes | Vibe: Focused on tech, individual stocks, and employment trends

Key Signals:

- Oracle's Role as a Data Center Builder: Cramer highlights Oracle's significance beyond software, noting its major role as a data center builder through its partnership with OpenAI, which is crucial for AI infrastructure.

- High Expectations Kill Tech Stocks: He reiterates the warning that "high expectations can be a real killer of tech stocks," cautioning against overvaluation even in promising sectors.

- Employment Situation Update: An interview with Paychex CEO John Gibson provides insights into the current employment landscape, offering a real-time pulse on labor market trends from a payroll provider.

"The biggest ambush in this market comes from Oracle, the debt laden software company turned data center builder."