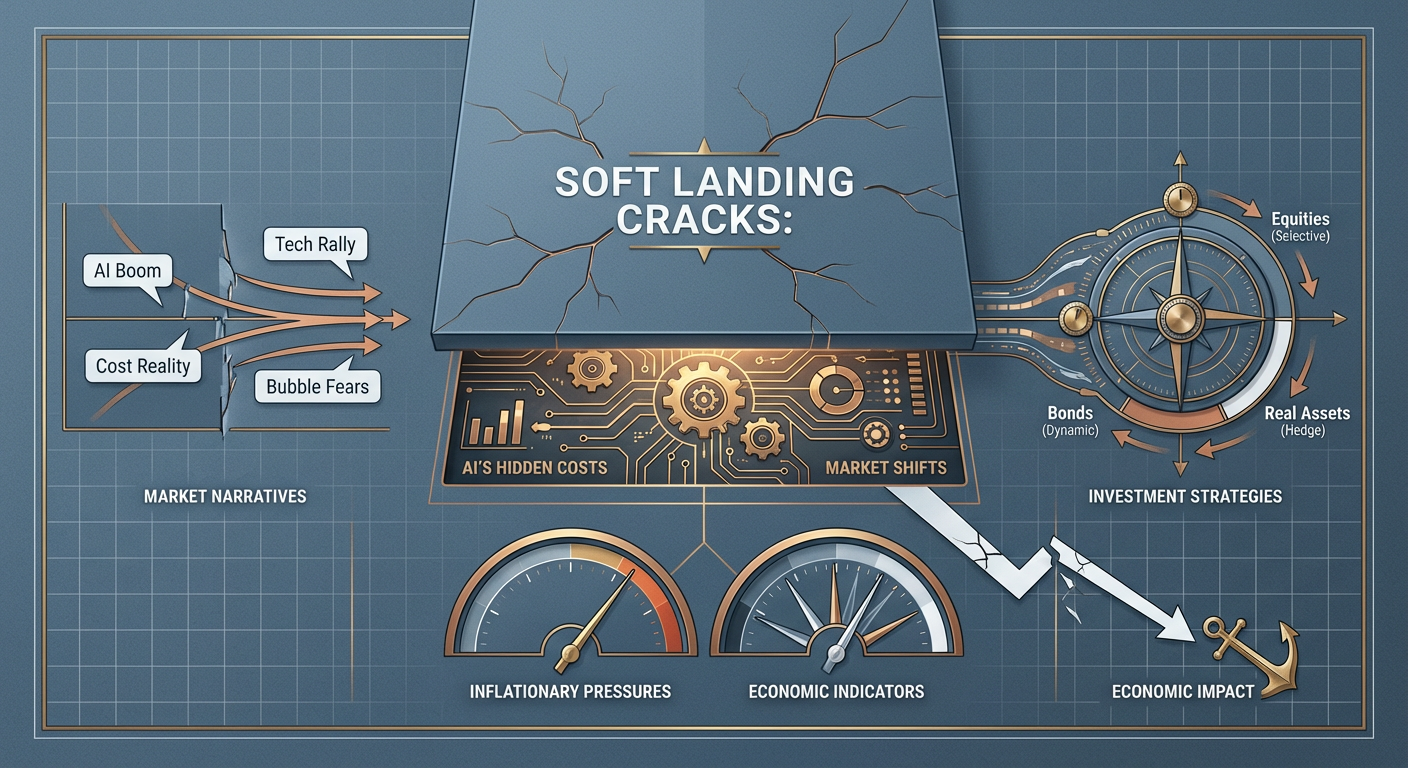

THE SOFT LANDING NARRATIVE IS CRACKING — WHAT'S NEXT FOR MARKETS AFTER THE AI BET?

THIS WEEK'S INTAKE 📊 12 episodes across 8 podcasts ⏱️ ~18 hours of market intelligence 🎙️ Featuring: David George (a16z Growth), Travis Kavulla (NRG), Andrew Beer (Dynamic Beta investments), Peter Boockvar, Senator Bill Cassidy, and strategists from HSBC, UBS, and State Street. 📅 Coverage: November 29th - December 2nd, 2025

We listened. Here's what matters.

The market narrative of a perfectly orchestrated soft landing is showing early signs of strain, with a growing divergence between the AI-fueled optimism powering mega-cap tech and the underlying macro realities. While the "Magnificent Seven" continue to defy gravity, smart money is increasingly focused on second-order effects: the rising electricity costs driven by AI data centers, the persistent housing affordability crisis, and the strategic pivot towards non-traditional diversifiers as the 60/40 portfolio's efficacy wanes. The prevailing wisdom is still betting on Fed rate cuts, but the signals suggest the path forward is anything but smooth, pushing strategists to reassess assumptions about growth, inflation, and portfolio resilience.

Here's what you need to know about the shifts beneath the surface.

THE BRIEFING

Electricity Bills: The Hidden Cost of the AI Revolution

The Setup: The AI boom is unequivocally here, but its insatiable demand for power is rapidly becoming a critical economic factor. While headlines focus on computing power, the physical infrastructure supporting AI—massive data centers—is a silent, but potent, driver of inflation and a challenge to energy grids.

The Signal: Electricity prices have been rising significantly since the pandemic, a trend now exacerbated by the exponential build-out of AI data centers. Travis Kavulla of NRG points out that this load growth directly impacts utility costs, shifting the dynamic from historically falling commodity prices to rapidly increasing transmission and distribution expenses. The grid simply isn't built for this sudden surge in demand, leading to higher costs for consumers and businesses alike.

The Voice:

"At a time when electricity prices have already been rising, is AI only going to drive them up further?" — Travis Kavulla, Odd Lots

The Level: New England's power market saw commodity costs fall by 50% (inflation-adjusted) over 20 years, contrasted with rising transmission costs – a trend now reversing dramatically due to AI.

So What: This isn't just about utility companies; it's a foundational input cost for every business and household. Rising electricity prices contribute to sticky inflation, erode consumer purchasing power, and create a significant drag on corporate margins, especially for energy-intensive industries. Investors should scrutinize energy exposure and consider the pass-through potential of these costs.

Housing Affordability: A Market Correction, Not a Data Illusion

The Setup: The housing market continues to grapple with accessibility issues for first-time homebuyers. While some narratives attribute this to shifting demographics, the core problem remains a supply-demand imbalance compounded by past policy choices.

The Signal: The "Animal Spirits" podcast debunks the idea that rising homebuyer age is due to faulty data; instead, it's a reflection of genuine affordability constraints. Proposed government "solutions" like 50-year mortgages or eliminating property taxes are seen as counterproductive, potentially subsidizing prices even further. The consensus among market observers suggests that the housing market needs time for natural corrections, such as slowing price growth and rising wages, to work through the system. Any external intervention risking further market distortion is viewed with skepticism.

The Voice:

"The narrative that housing affordability sucks is based on faulty data." — Animal Spirits co-host

The Level: House prices need to fall, or wages need to rise, significantly to restore historical affordability metrics, but rapid corrections are often met with political resistance.

So What: The housing market's slow recalibration means sustained pressure on consumer spending and potential ripple effects across other sectors. Real estate valuations remain a thorny issue, and smart allocators are watching for signs of genuine market-driven equilibrium rather than policy-induced distortions. The implications touch everything from retail to regional banking.

The 60/40 Portfolio is Dead: The Rise of Liquid Alternatives

The Setup: The traditional 60/40 portfolio, once the bedrock of diversified investing, has faced significant challenges in recent years, prompting a re-evaluation of wealth management strategies.

The Signal: Niels and Andrew Beer discuss a "seismic shift" in asset allocation, highlighting the failure of the 60/40 model. Investors are increasingly seeking alternative diversifiers, particularly liquid alternatives and trend-following ETFs, to navigate volatile markets. The focus is on strategies that generate returns non-correlated to traditional equities and bonds, acknowledging the limitations of replicating complex CTA strategies through simpler products.

The Voice:

"There really has been a seismic shift in asset allocation and wealth management in that, in that, you know, the, the, the playbook of 60/40 just stopped working." — Andrew Beer, Top Traders Unplugged

The Level: Alternative strategies are gaining traction in private wealth management, mirroring institutional trends as advisors seek genuine diversification beyond traditional asset classes.

So What: For allocators, this means a deeper dive into investment vehicles that historically weren't mainstream. Understanding the nuances of liquid alts, their true diversification benefits versus their costs, and their potential for systematic risk management is crucial. This shift indicates a secular move away from passive reliance on broad market diversification towards more active, multi-asset approaches.

2026: The Year of the Dividend Stock?

The Setup: For years, dividend stocks, particularly in the U.S., have been overshadowed by growth stocks and the prevalence of stock buybacks, leading to underperformance compared to international counterparts.

The Signal: Dan Lefkovitz and Susan Dziubinski from "The Long View" argue that 2026 could mark a turning point for dividend stocks. The current trend shows companies dedicating more capital to share repurchases than dividends, a situation that may be unsustainable. As economic growth potentially normalizes and capital preservation becomes more paramount, the consistent income and total return potential of dividend-paying companies could regain favor.

The Voice:

"2025 is going to be the fifth straight year in which more money is being spent on share repurchases by companies than dividends." — Dan Lefkovitz, The Long View

The Level: A potential shift in corporate capital allocation strategies could redirect billions from buybacks to dividends, making income-generating investments more attractive.

So What: This represents a thematic rotation opportunity. As equity markets may face choppier waters post-AI-euphoria, the stability and income stream from high-quality dividend stocks could offer both downside protection and compelling total returns. Investors should look beyond simple dividend yields to focus on companies with sustainable payout ratios and strong free cash flow generation.

THE HEAT MAP

🔥 Heating Up:

- AI's Energy Demand: Rising electricity costs and grid strain (Odd Lots)

- Dividend Stocks (2026 Outlook): Potential for a breakout year as capital allocation shifts (The Long View)

- Liquid Alternative Strategies: Replacing the failing 60/40 playbook (Top Traders Unplugged)

- Private Credit: Growing importance in the broader financial ecosystem (Bloomberg Surveillance)

🧊 Cooling Off:

- The 60/40 Portfolio: Seen as increasingly ineffective for diversification (Top Traders Unplugged)

- Housing Affordability "Quick Fixes": Policy interventions viewed as distorting rather than solving (Animal Spirits)

👀 On Watch:

- Macro Risks for 2026: Six specific areas influencing investment strategies – from geopolitics to interest rates (Bloomberg Surveillance)

- S&P Global's Diversification: How the company behind the market maintains its moat amidst AI advancements (The Intrinsic Value Podcast)

- Sustainability of US Dollar Strength: Implications for global trade and investment flows (Bloomberg Surveillance)

THE CONTRARIAN BET

While the prevailing market sentiment remains heavily focused on the AI narrative driving mega-cap tech, Peter Boockvar on The Compound and Friends takes a contrarian stance, arguing that oil could be next year's gold. He suggests that while the use case for AI is strong, the infrastructure frenzy behind it could be generating an underlying bubble. The smart money is positioning for real asset protection and inflationary hedges, seeing oil as a more grounded bet than continued exponential tech growth, especially given geopolitical risks and supply constraints.

THE BOTTOM LINE

The market is in a delicate dance: extended AI-driven equity valuations versus palpable underlying macro pressures. Investors need to differentiate between foundational shifts, like AI's energy footprint, and cyclical corrections, such as housing affordability. Diversification strategies are evolving beyond traditional molds, making a case for real assets and income generation in a landscape that's far from a smooth glide path. Watch for cracks in the soft landing narrative, as they will likely signal the next major rotation.

📚 APPENDIX: EPISODE COVERAGE

1. Animal Spirits: "Talk Your Book: The State of the Housing Market"

Guests: Ben Carlson, Michael Batnick (Hosts)

Runtime: ~1 hour | Vibe: Data-driven debunking of housing market myths

Key Signals:

- Housing Affordability Realities: The narrative of flawed survey data for first-time homebuyer demographics is largely debunked; the core issue remains genuine affordability challenges.

- Market-Driven Correction: Government interventions like 50-year mortgages or tax breaks are considered counterproductive, suggesting the market needs time for natural adjustments like slowing price growth and rising wages.

- Policy Ineffectiveness: The hosts emphasize that policy attempts to subsidize housing further would only exacerbate the problem, advocating for patience and letting market forces work.

"The narrative that housing affordability sucks is based on faulty data."

2. Invest Like the Best with Patrick O'Shaughnessy: "David George - Building a16z Growth, Investing Across the AI Stack, and Why Markets Misprice Growth - [Invest Like the Best, EP.450]"

Guests: David George (General Partner, a16z Growth)

Runtime: ~1 hour 25 minutes | Vibe: Deep dive into venture capital, growth equity, and the mechanics of large-scale tech investing

Key Signals:

- AI Investment Landscape: David George shares insights into a16z Growth's strategy for investing across the AI stack, from core infrastructure to application layers.

- Market Mispricing of Growth: Discussion centers on how traditional public markets often misprice the true potential and longevity of high-growth companies, especially in emerging tech sectors.

- Venture Capital in a Mature Stage: An exploration of how a venture capital firm with significant capital, like a16z Growth, approaches deployment and portfolio construction in later-stage private companies.

"The best companies are often built during times of scarcity, and those are the best times to be investing, to be quite honest."

3. Bloomberg Surveillance: "Bloomberg Surveillance TV: December 1st, 2025"

Guests: Max Kettner (Chief Multi-Asset Strategist, HSBC), Senator Bill Cassidy, and other unnamed guests.

Runtime: ~1 hour | Vibe: Focused analysis of upcoming macro trends and policy implications

Key Signals:

- AI's Impact on Equity & Credit: The overarching narrative for 2026 markets is projected to be how companies adopt AI, driving earnings and reshaping both equity and credit landscapes.

- Six Macro Risks for 2026: Discussion highlights specific macro factors (unspecified in provided data) expected to shape investment strategies for the coming year, hinting at a complex global environment.

- Private Credit Outlook: Increasing attention on the private credit market as an important component of the financial system, its growth, and its role as an alternative financing source.

"The big narrative for markets is how companies are going to adopt AI and that's going to drive earnings."

4. The Compound and Friends: "Why Oil Could Be Next Year’s Gold"

Guests: Peter Boockvar (Chief Investment Officer, Bleakley Financial Group)

Runtime: ~1 hour 15 minutes | Vibe: Lively discussion on inflation, asset bubbles, and overlooked macro trends

Key Signals:

- AI Bubble Debate: The discussion grapples with whether the current AI enthusiasm represents a bubble, distinguishing between the legitimate "use case" and the potential for overheating infrastructure investment.

- Inflation Expectations: Insights into current inflation trends and how they might influence market behavior, with a focus on sticky components and potential upside surprises.

- Oil as a Long Bet: A contrarian view suggesting that oil could outperform traditional safe-havens like gold in the coming year, given inflationary pressures and geopolitical considerations.

"The big thing that happened this week was this insane reversal of the pretty short but pretty sharp sell off of AI stocks at the end of last week."

5. Odd Lots: "Travis Kavulla Explains Why Electric Bills Shot Up"

Guests: Travis Kavulla (Vice President of Regulatory Affairs, NRG)

Runtime: ~1 hour 30 minutes | Vibe: In-depth, technical exploration of energy markets and regulatory challenges

Key Signals:

- AI's Impact on Electricity Prices: Kavulla explains how the massive energy demands of AI data centers are a significant driver behind rising electricity bills, exacerbating post-pandemic price increases.

- Regulatory Market Divergence: Contrasting competitive vs. regulated electricity markets illustrates how different frameworks impact pricing and investment in grid infrastructure.

- Grid Strain and Modernization: The complexities of managing the electricity grid, integrating new technologies like batteries, and the urgent need for policy updates to address current energy demands.

"At a time when electricity prices have already been rising, is AI only going to drive them up further?"

6. Bloomberg Surveillance: "Stocks Set for Monthly Loss as CME Outage Disrupts Trading"

Guests: Steve Sadove (Former CEO, Saks), Max Kettner (HSBC), Mariana Brandman (UBS), Shawn Cruz (TD Ameritrade)

Runtime: ~1 hour | Vibe: Real-time market reaction and economic analysis

Key Signals:

- Q4 Earnings Expectations: Analysts are cutting Q4 earnings expectations even further, suggesting a cautious outlook despite overall market buoyancy in some sectors.

- Luxury Retail Health: Discussion provides a pulse check on the high-end retail market, often an indicator of broader consumer health and discretionary spending.

- Monetary Policy Tailwinds: Exploration of how potential policy easing could provide an economic boost, but with underlying concerns about its sustainability and inflationary implications.

"Q4 earnings expectations have been slashed even further."

7. The Long View: "The Morning Filter: Why 2026 Could Be a Breakout Year for Dividend Stocks"

Guests: Dan Lefkovitz (Strategist, Morningstar Indexes), Susan Dziubinski (Director of Content, Morningstar)

Runtime: ~50 minutes | Vibe: Strategic long-term investment analysis

Key Signals:

- Dividend Underperformance: U.S. dividend stocks have lagged global counterparts, partly due to the recent boom in stock buybacks and growth stock dominance.

- Buybacks vs. Dividends: Companies are spending more on share repurchases than dividends, and this trend might be reaching an inflection point, with potential implications for investors seeking income.

- 2026 Dividend Outlook: The episode forecasts 2026 as a potential breakout year for dividend stocks, as market conditions and corporate capital allocation strategies may shift.

"2025 is going to be the fifth straight year in which more money is being spent on share repurchases by companies than dividends."

8. The Intrinsic Value Podcast - The Investor’s Podcast Network: "TIVP048: S&P Global (SPGI): The Company behind the Market w/ Daniel Mahncke & Shawn O’Malley"

Guests: Daniel Mahncke, Shawn O’Malley (Hosts)

Runtime: ~1 hour 45 minutes | Vibe: Detailed fundamental company analysis

Key Signals:

- S&P Global's Diversification: An in-depth look at S&P Global's various revenue streams beyond its well-known indices, including ratings, market intelligence, and commodity insights.

- Economic Moat: The discussion highlights S&P Global's strong competitive advantages, particularly in its ratings business, which benefits from high barriers to entry and regulatory endorsement.

- AI's Impact on Financial Infrastructure: Analysis of how AI could influence S&P Global's operations and services, from data analytics to automated rating processes, and how the company is positioned to adapt.

"The real heavyweight inside S&P Global, both in terms of revenue and also in terms of profits, is definitely the ratings business."

9. Mad Money w/ Jim Cramer: "Mad Money w/ Jim Cramer 12/1/25"

Guests: Jim Cramer (Host)

Runtime: ~45 minutes | Vibe: High-energy, actionable stock market commentary

Key Signals:

- Stock Picks and Sector Favorites: Cramer offers his latest stock recommendations and highlights sectors he believes are poised for growth or present value opportunities.

- Earnings Reaction Analysis: Insights into how various company earnings reports are impacting stock prices and broader market sentiment.

- Market Psychology: Discussion on investor sentiment, retail trading trends, and the emotional drivers behind market movements.

"There's always a bull market somewhere, and you have to find it."

10. Top Traders Unplugged: "SI376: What They’re Only Now Starting to See ft. Andrew Beer"

Guests: Andrew Beer (Managing Member, Dynamic Beta investments)

Runtime: ~1 hour 10 minutes | Vibe: Sophisticated analysis of investment strategies and wealth management evolution

Key Signals:

- Failure of the 60/40 Portfolio: A frank discussion on why the traditional 60/40 asset allocation model is no longer effective in the current market environment.

- Rise of Liquid Alternatives: The growing importance of alternative strategies, including trend ETFs and systematic trend-following, to provide genuine diversification.

- Replication vs. Traditional CTAs: Explores the challenges and nuances of replicating complex CTA strategies and the "true cost" of various investment approaches for allocators.

"There really has been a seismic shift in asset allocation and wealth management in that, in that, you know, the, the, the playbook of 60/40 just stopped working."

11. Daily Stock Picks: "Alpha Picks Live 🎯 | Is This a Bubble… or the Start of a Monster Rally? 🚀📉🧠"

Guests: Various hosts and analysts

Runtime: ~1 hour | Vibe: Real-time market debate and speculative analysis

Key Signals:

- Bubble or Monster Rally?: A central debate on whether current stock market valuations, particularly in tech, signal an impending bubble or the beginning of a prolonged bull run.

- AI's Market Impact: Discussion on the ongoing influence of AI on stock performance and how it might re-rate entire sectors.

- Strategic Positioning: Analysts share their tactical approaches for navigating the current market uncertainty, emphasizing the need for adaptable investment strategies.

"Even if you think this is a bubble, we could still be early."

12. Bloomberg Surveillance: "Bloomberg Surveillance TV: December 2nd, 2025"

Guests: Mariana Brandman (UBS Global Wealth Management), Steve Sadove (Former CEO, Saks), Max Kettner (HSBC), Shawn Cruz (TD Ameritrade)

Runtime: ~1 hour | Vibe: Daily market wrap-up with expert insights

Key Signals:

- Magnificent Seven Performance: Updates and analysis on the continued performance and market dominance of the top tech companies, and whether their run is sustainable.

- US Dollar Strength: Discussion on the factors contributing to the US dollar's current strength and its implications for global trade and currency markets.

- Chinese Equities Outlook: Expert perspectives on the prospects for Chinese stock markets, including regulatory environment, economic growth, and potential foreign investment.

"We're almost maximum overweight in equities, particularly in the US."